As a leading provider of financial information, EODHD recognizes the vital role that high-quality data plays in the decision-making processes of professionals across various industries.

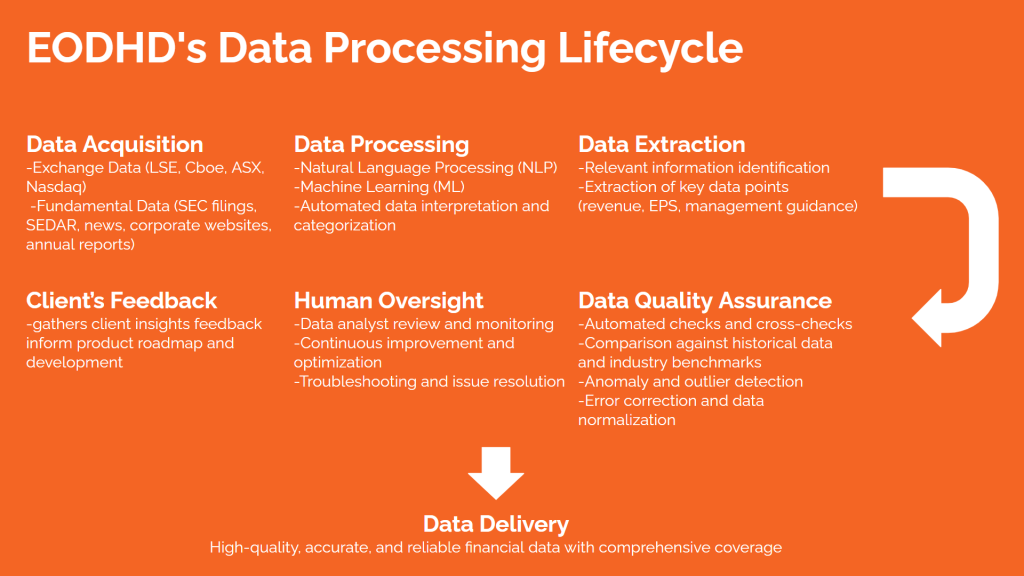

To meet the demanding standards of our clients, we have developed a data processing system that seamlessly integrates cutting-edge technology with human expertise.

This article will delve into the various aspects of our data processing approach, highlighting how we ensure the delivery of consistently accurate and timely financial data.

Quick jump:

Data Acquisition

Our data processing system’s foundation lies in acquiring raw data from a diverse range of reputable sources. To ensure the breadth and depth of our coverage, we have established direct contracts with several major exchanges worldwide. These include the London Stock Exchange Group (LSE) for UK data, Cboe Europe Equities for European markets, and the Australian Stock Exchange (ASX) for Australian feeds. For the US market, we rely on the Nasdaq for end-of-day and delayed data.

In addition to market data, we also place a strong emphasis on gathering fundamental data. This information is collected from a variety of public resources, including financial news providers, investor relations corporate websites, and published annual reports. For US-based companies, we source data directly from reports filed on sec.gov, while in Canada, we utilize sedar.com. By leveraging multiple data sources, we can paint a more complete picture of a company’s financial health and performance.

Advanced Data Processing Techniques

Our proprietary data quality assurance system takes over once our NLP and ML algorithms have collected and processed the data. At the heart of our data processing system is a powerful combination of Natural Language Processing (NLP) and Machine Learning (ML) techniques. These advanced technologies allow us to efficiently analyze and interpret vast amounts of unstructured data. EODHD analyzes company news, press releases, financial reports, declarations, and announcements.

By employing NLP, our algorithms can quickly identify and extract relevant information from textual data sources. This process involves breaking down the text into its constituent parts, understanding the context and meaning of the words. Which used to identify key phrases and sentiments. Through ML, our system continuously learns and adapts, refining its ability to interpret and categorize financial information accurately.

Our NLP and ML in our data processing pipeline enable us to automate the extraction of crucial data points. The system derives revenue figures, earnings per share, and management guidance. This not only saves time and reduces the risk of human error but also allows us to process and integrate new information rapidly, ensuring that our database remains up-to-date and comprehensive.

Start the journey with high-quality financial data with a free monthly subscription.

Data Quality Assurance

A Multi-Layered Approach At EODHD, we understand that the accuracy and reliability of our data are paramount. To ensure the highest levels of data quality, we have implemented a multi-layered approach to data validation and error correction. Once the data has been collected and processed through algorithms, our proprietary data quality assurance system takes over.

This system consists of a series of checks, designed to identify and rectify any potential issues in the data. Our algorithms compare the extracted information against historical data, industry benchmarks, and other relevant sources to detect any anomalies or outliers. The system automatically triggers a series of corrective measures when it identifies discrepancies, ensuring that it cleans the data.

By automating the data quality assurance process, we can maintain the integrity of our financial data on a scale that would be impossible to achieve through manual checks alone. This multi-layered approach to data validation, combined with advanced data processing techniques, ensures our commitment to delivering reliable financial information.

Human Expertise and Oversight – The Vital Role of Our Data Analysts

While our automated data processing system is highly sophisticated, we recognize the invaluable role that human expertise plays in ensuring the quality and relevance of our financial data. Behind the scenes, our team of skilled data analysts works tirelessly to monitor, refine, and optimize our data processing pipelines.

These experienced professionals bring a deep understanding of financial markets, accounting principles, and data management best practices to their roles. They continuously review the output of our automated systems, looking for opportunities to improve data quality, expand coverage, and introduce new data sets that align with the evolving needs of our clients.

Our data analysts also play a critical role in troubleshooting and resolving any complex data issues that may arise. By leveraging their domain expertise and working closely with our technology teams, they can quickly identify the root cause of any problems and implement effective solutions. This human oversight ensures that our data processing system remains robust, reliable, and responsive to the ever-changing landscape of the financial world.

Client Feedback Integration

Shaping our services through collaboration at EODHD, we believe that our success is linked to the success of our clients. To ensure our financial data services meet the highest standards and deliver value, we integrate feedback into our development.

Our Support Team, available 24/7, serves as the primary point of contact for clients, fostering open communication and gathering insights into their needs. Feedback is regularly passed on to our data analysts and technology teams, informing our product roadmap and driving continuous improvement initiatives.

Our support service is regarded as the best in the industry, as reflected in the positive reviews from our clients on Trustpilot.

By collaborating closely with our clients, we can understand their challenges and develop tailored solutions that address their specific requirements. This client-centric approach ensures that our financial data services remain aligned with the real-world needs of professionals across various industries.

Conclusion

EODHD’s commitment to delivering high-quality financial data is rooted in our robust and largely automated data processing system. By combining advanced technologies like NLP and ML with human expertise and a multi-layered approach to data quality assurance, we can efficiently process vast amounts of financial information while maintaining the highest standards of accuracy and reliability.

Our dedication to client satisfaction and continuous improvement drives us to refine and expand our data processing capabilities constantly. By integrating client feedback, we can ensure that our services remain robust, empowering professionals to make informed decisions.

“At EODHD, we pride ourselves on being a trusted partner to our clients, providing them with the comprehensive, accurate, and timely financial data they need to navigate the complexities of today’s global markets. Through our unwavering commitment to data quality and our innovative approach to data processing, we will continue to set the standard for excellence in financial information services.”

Den Alaev, CEO at EODHD