When you’re building a fintech startup, it’s easy to underestimate how much time it takes to get the data you need – until something goes wrong.

Adonia La Camera, founder of Pro Stock Tracker, learned this early:

“We had a clear product vision, but I didn’t want to spend months wrestling with unreliable data or endless support tickets. We needed a provider we could trust – so we could focus on building.”

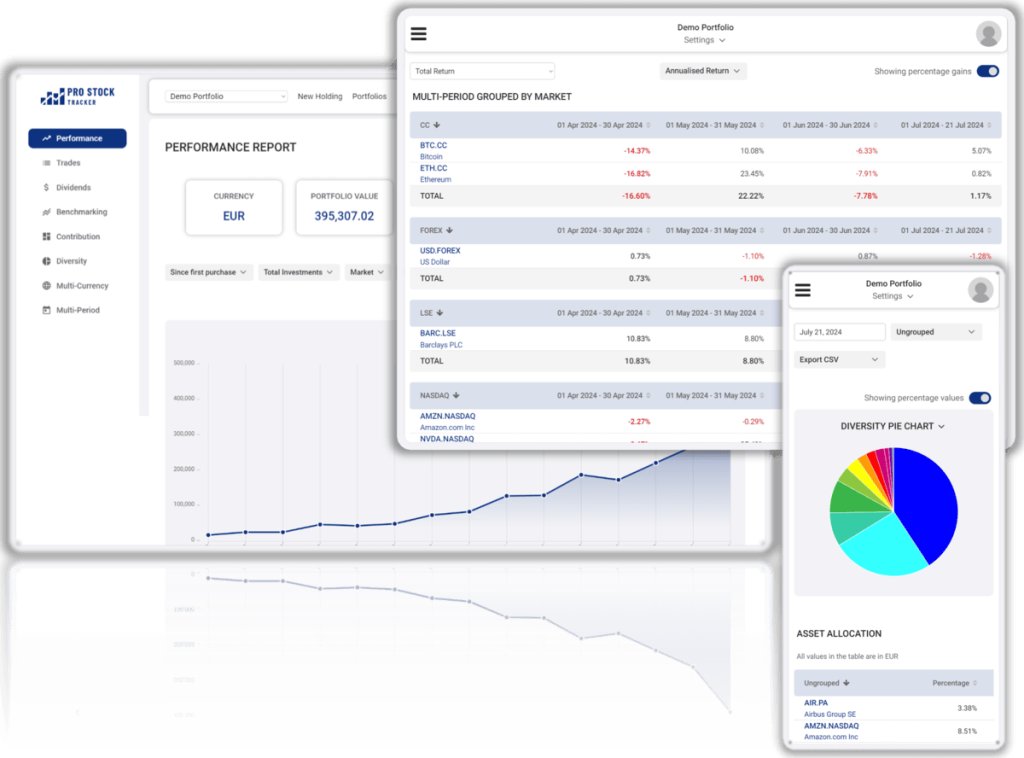

Pro Stock Tracker is a versatile portfolio tracker for long-term investors who want to see how their assets are actually earning – not just lists of holdings and price charts. It offers advanced reporting, automated tracking of dividends and stock splits, and a custom-built money-weighted rate of return engine.

But for all of that to work, the underlying data had to be accurate, consistent, and global.

Here’s how EODHD helped turn a strong product idea into a scalable platform – while avoiding the most common startup pitfalls.

Watch the full interview with Adonia La Camera

Problem 1: Wasting Time on Bad Data

Before switching to EODHD, Adonia had worked with other financial data providers. The problems were all too familiar to anyone who’s tried to build a serious product on shaky data:

- Missing fields

- Inconsistent formats

- Outdated information

- Support that never responds

“When data breaks, users open tickets. Then your team spends time fixing the data instead of building the product. It’s a huge distraction.”

With EODHD, the improvement was immediate:

➡️ Over 80% fewer support tickets related to data quality

➡️ No more workarounds, manual fixes, or confused users

➡️ More time spent building features, less time putting out fires

“We saved time, saved costs, and could reinvest that into improving the platform.”

Problem 2: Choosing the Right Provider – Without Regrets

Many startups fall into one of two traps: starting with free datasets (because there’s no budget) or going straight to big-name data providers (usually after raising investment). In both cases, surprises come later – and not the good kind.

Having already stumbled with some providers early on, Adonia took a more methodical approach. As a coder, he built a comparison table of data vendors, scoring them on key factors:

- Global coverage

- API stability

- Documentation clarity

- Support responsiveness

- Transparent pricing

“EODHD stood out. The API was stable, the docs were clean, and when we had questions, support actually replied. That builds trust fast.”

Problem 3: Additional Calculations by Users? No Way!

One of Pro Stock Tracker’s core goals was to remove all manual work for users – especially when it came to already-adjusted numbers. Manually tracking dividends or adjusting for stock splits? Not acceptable.

Adonia needed more than just basic stock prices (which anyone can find on Yahoo). He needed an institutional-grade dataset.

Pro Stock Tracker relies on three core datasets from EODHD:

✅ End-of-day prices

✅ Dividends

✅ Stock splits

These datasets are essential for generating clean, automated performance reports based on the platform’s money-weighted return methodology. With this setup, users get an accurate, up-to-date picture of their portfolio performance – with zero manual effort.

“Users don’t have to enter anything. We bring the data automatically. That’s a better experience – and it makes us more scalable.”

Problem 4: Planning for Growth – Not Just a Quick Fix

Many startups start with the cheapest or fastest data they can find, only to hit unexpected limitations later. Adonia took a different approach – and it paid off.

Three years on, Pro Stock Tracker is still growing alongside EODHD. The team is now rolling out more advanced analytics and integrating directly with major brokers to sync transactions.

“We never had to switch providers. EODHD scaled with us. And they keep adding more – it’s not a static product.”

This kind of long-term reliability means less technical debt, no painful migrations, and more time to focus on building rather than fixing.

Bonus Advice from Adonia: The Name Matters

While data is critical, Adonia has an one little extra tip for fellow founders:

“Pick a name that reflects what you do. It helps with SEO, builds user trust, and improves discoverability. Don’t call your product something silly – especially in finance.”

That’s why Pro Stock Tracker has a name that’s clear, searchable, and perfectly aligned with its purpose – just like EODHD.

Final Takeaway

If you’re building a fintech product, these questions will define your success:

- Can you trust your data?

- Will your users stay confident and engaged?

- Will integration steal weeks of your time?

- Will your provider keep up as you grow?

For Pro Stock Tracker, EODHD answered “yes” to all of them.

“It’s not just data. It’s the confidence to build, scale, and focus on what matters. That’s why we’re still here, three years later – and still using EODHD.”

If you are looking for a right data provider for your startup, talk to our team.