The artificial intelligence narrative in 2025 has become dangerously narrow. While billions flow into data centers and semiconductor manufacturing, the most compelling AI investment stories are unfolding outside Silicon Valley—in logistics warehouses, bank operations centers, and agricultural fields.

Currently, the challenge isn’t finding AI exposure – it’s identifying where AI actually generates measurable returns versus where massive investments disappear into cyclical downturns and margin compression.

Quick jump:

- 1 Which sectors show measurable AI ROI right now?

- 2 Why do logistics companies lead in AI profitability?

- 3 How is banking extracting real value from AI investments?

- 4 What’s wrong with agricultural equipment AI strategies?

- 5 Why aren’t pharmaceutical AI investments paying off yet?

- 6 How should investors evaluate AI impact in manufacturing?

- 7 What are the key patterns separating AI winners from losers?

- 8 What’s the investment strategy for non-tech AI exposure?

- 9 What’s the bottom line for AI investing beyond tech?

- 10 QA

- 11 Get Started Today

Which sectors show measurable AI ROI right now?

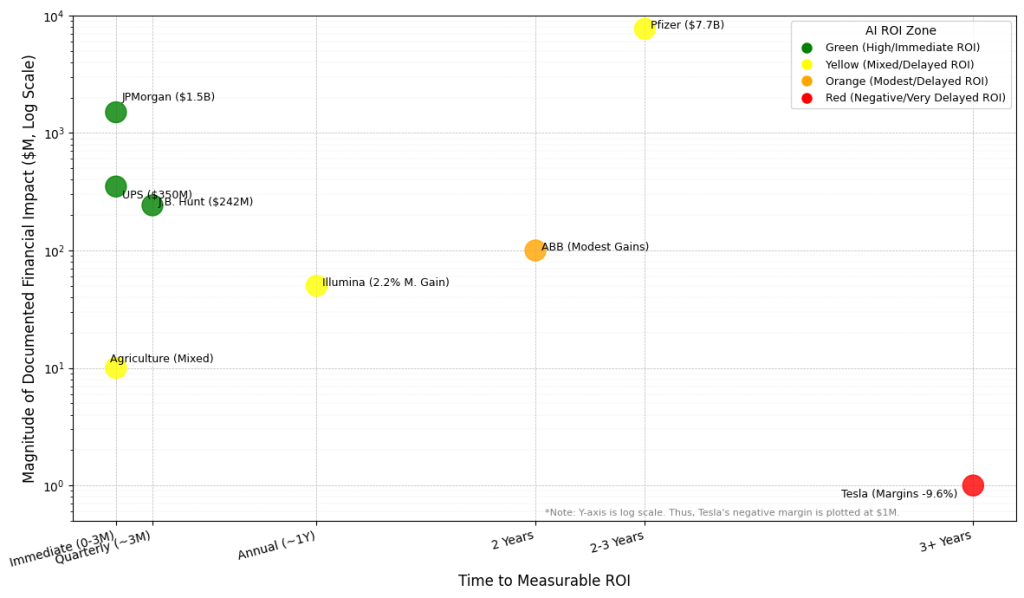

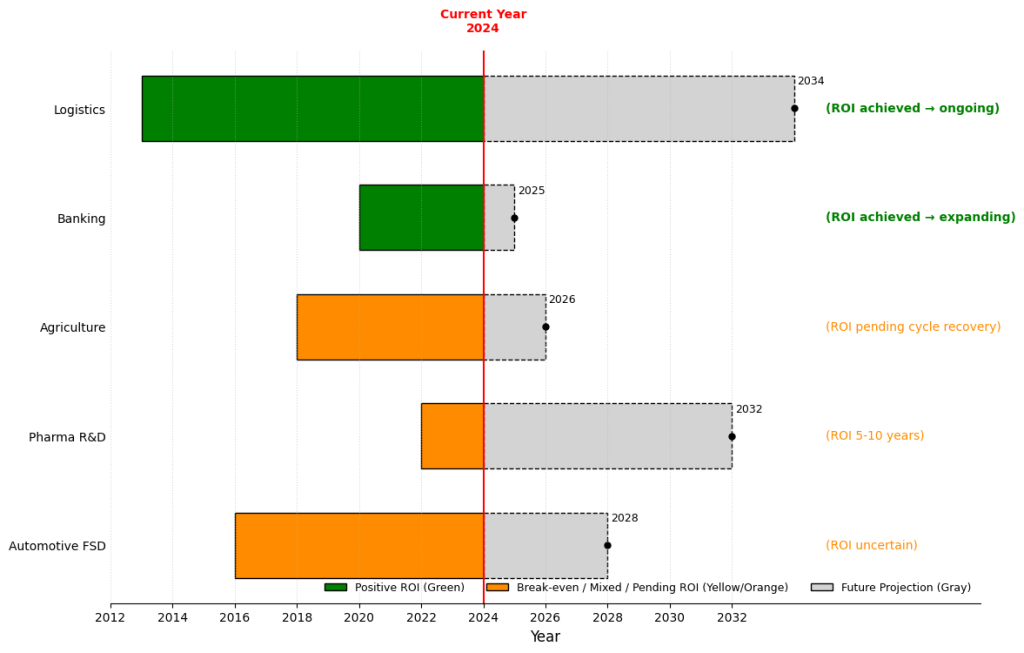

Two sectors demonstrate clear, quantifiable margin improvements from AI deployments: logistics and banking.

Logistics leaders deliver documented savings: UPS generates $350+ million in annual savings through its ORION routing system, eliminating 185 million miles from routes and cutting 20% idle time. J.B. Hunt’s 360° platform drove an 18% earnings beat in Q3 2025, with EPS of $1.76 crushing analyst estimates of $1.46-$1.49.

Banking shows revenue growth, not just cost cuts: JPMorgan Chase(JPM) achieved 20% sales growth in Asset & Wealth Management (2023-2024) through AI-powered advisor tools, while preventing $1.5 billion in fraud with 98% accuracy. The bank deploys 450+ AI use cases used daily by 125,000 of its 250,000 employees.

Three sectors show moderate but mixed results: pharmaceuticals (Pfizer(PFE) $7.7 billion cost savings, Illumina margin expansion to 22.6%), agriculture equipment (proven technology overwhelmed by cyclical collapse), and industrial automation (ABB performing well despite demand headwinds).

Two sectors show weak current impact despite heavy investment: automotive (Tesla(TSLA) margins collapsing from 16.8% to 7.2% in 2024 to 5.8% 2025 Q3 despite AI leadership) and biotech (Moderna(MRNA) losing $3.6 billion despite 65% AI platform adoption).

Why do logistics companies lead in AI profitability?

Logistics represents the clearest AI return on investment across all sectors examined, driven by immediate feedback loops and high-frequency optimization opportunities.

UPS invested $250 million starting in 2013 in its ORION system. By 2024, 97% of its van fleet runs on AI-optimized routes, analyzing over 200,000 routing options per driver daily. The system updates routes in real-time for traffic, weather, and package flow, cutting driver routes by 2-4 miles daily while reducing fuel consumption by 8 million gallons annually.

During the 2024 holiday surge, ORION enabled UPS to handle a 15% volume spike without adding vehicles. The documented annual savings exceed $350 million with 185,000 metric tons of CO2 emissions eliminated.

J.B. Hunt(JBHT) built a digital marketplace connecting shippers with nearly one million trucks (approximately one-third of North America’s trucking capacity). Powered by Google Cloud’s AI infrastructure, the J.B. Hunt 360° platform delivers instant quotes and transparent pricing.

The financial impact materialized quickly: Q3 2025 operating income jumped 8% to $242.7 million driven by “structural cost removal” and improved productivity. Customer retention sits at 95%, and their 360box service grew volume by 11% year-over-year. The stock surged 18% following the earnings announcement.

These aren’t promise-based valuations—logistics companies deliver documented cost reductions and margin expansion measured in quarters, not years.

How is banking extracting real value from AI investments?

JPMorgan Chase is systematically becoming the world’s first fully AI-powered megabank, with measurable impacts across multiple business lines.

With a $17 billion technology budget in 2024 ($1.3 billion dedicated specifically to AI), JPMorgan deployed over 450 AI use cases through its LLM Suite platform. Unlike most corporate AI initiatives functioning as glorified chatbots, JPMorgan extracts quantifiable value:

- Revenue growth metrics: Asset & Wealth Management achieved a 20% gross sales increase (2023-2024), driven by Coach AI helping advisors respond to client inquiries 95% faster.

- Productivity improvements: Software development gained 10-20% productivity through AI coding assistants, while the payments division achieved a 50% reduction in manual payment exceptions.

- Risk management enhancement: AI-powered fraud detection prevented $1.5 billion in losses with 98% accuracy, while anti-money laundering surveillance cut false positives by 60%.

The strategic implications extend beyond current savings. If JPMorgan beats competitors to full AI integration, it will enjoy structurally higher margins before the industry catches up – enabling market share gains in investment banking, wealth management, and commercial lending where marginal efficiency advantages compound over time.

Banking shows big, measurable AI impact – the only sector besides logistics with documented margin improvements and revenue growth directly attributable to AI deployments.

What’s wrong with agricultural equipment AI strategies?

Agriculture equipment manufacturers have proven AI technology deployed at scale, but cyclical industry pressures completely overwhelm any margin benefits.

The technology is real and impressive: John Deere’s(DE) See & Spray system uses computer vision to identify weeds and spray herbicide only where needed, achieving 59% average herbicide reduction and saving farmers $15.70 per acre. In 2024 alone, the technology saved an estimated 8 million gallons of herbicide. The company’s autonomous tractors operate in commercial farms today.

AGCO invested $2 billion in acquiring 85% of Trimble’s agriculture business, creating PTx Trimble. Precision technology adoption on AGCO machines jumped from 20% to 70%, targeting $2 billion in precision agriculture sales by 2029.

CNH Industrial plans to double Precision Tech sales to 10% of agriculture revenue by 2030, targeting 16-17% mid-cycle EBIT margins.

But none of this technology has protected margins from cyclical devastation:

John Deere’s Q3 2024 net income fell to $1.73 billion from $2.98 billion year-over-year, with sales down 17%. AGCO’s Q4 2024 sales dropped 24%, with production hours plunging 33%. CNH’s Q1 2025 adjusted EBIT margin collapsed to 3.2% from 9.0%, with agriculture segment sales down 23%.

The industry suffers from dealer inventory destocking, weak farm income, and global oversupply. AI-driven cost reductions are measurable—but they’re being overwhelmed by demand destruction.

Agriculture equipment shows moderate AI integration with proven technology, but cyclical pressures completely negate any margin benefits. These are long-term positioning plays, not near-term margin expansion stories.

Why aren’t pharmaceutical AI investments paying off yet?

Pharmaceutical and biotech companies show mixed results, with operational efficiency gains visible but drug discovery AI requiring 5-10 year timelines before generating returns.

Pfizer made AI central to its R&D strategy, deploying the OncoScout platform for cancer drug discovery and targeting a 25-30% improvement in R&D probability of success. The Charlie AI platform handles internal operations from legal reviews to content creation.

Financial results show progress on cost management: Pfizer achieved $4 billion in net cost savings in 2024, increasing to $4.5 billion by the end of 2025, plus another $1.5 billion from manufacturing optimization by 2027. Full-year 2024 revenues reached $63.6 billion with 7% operational growth, with management projecting a return to pre-pandemic operating margins.

Moderna built an “AI-native” company with its mChat platform, seeing 65% employee adoption. AI is embedded across drug design, clinical trials, and manufacturing operations. The company reduced costs by 27% in 2024 versus 2023.

But Moderna is hemorrhaging money. Full-year 2024 revenue was $3.2 billion with a net loss of $3.6 billion. The post-COVID vaccine cliff is brutal, and AI adoption hasn’t prevented the collapse.

Illumina in genomics shows a different story: clear margin expansion through operational excellence. Core Illumina non-GAAP operating margins improved from approximately 20.5% to 22.6% in Q3 2024, targeting 25% for 2024 and 27% for 2025. Revenue declined approximately 3% due to macro headwinds, but efficiency gains drive profitability.

Pharma and biotech show mixed results. Margin improvements are visible at Pfizer and Illumina but driven more by cost discipline than AI-specific breakthroughs. Drug discovery AI won’t show ROI for 5-10 years due to development and regulatory timelines.

How should investors evaluate AI impact in manufacturing?

Automotive and manufacturing sectors show weak AI impact currently, with massive investments positioning companies for the future, but cyclical demand weakness is overwhelming any technology benefits today.

Tesla invested massively in AI infrastructure: The company completed its Cortex AI training cluster in Q4 2024, expanded AI training by 400% year-over-year, and has over 2 billion miles driven on Full Self-Driving software. The company achieved a record-low cost of goods sold per vehicle at under $35,000.

Yet operating margins are in freefall: from 16.8% in 2022 to 9.2% in 2023 to 7.2% in 2024. Automotive gross margins declined from 23.3% to 18.4%. Net income fell 53% to $7.1 billion. Deliveries and production both declined year-over-year for the first time in company history.

The culprit is price wars in China and EV market saturation. AI-driven manufacturing efficiencies are real but cannot overcome revenue erosion.

In industrial automation, ABB performed best with $32.9 billion in revenue and 18.1% operational EBITA margins. The company reports 80% of its robotics offerings now integrate AI or advanced software. But even ABB’s robotics division operates at just 12.1% EBITA margin, well below the group average.

Rockwell Automation saw fiscal 2024 sales fall 7% to $8.26 billion, with margins compressing across all segments despite acquisitions of Clearpath Robotics and Verve cybersecurity.

Automotive and manufacturing show a weak AI impact currently. Massive investments position companies for the future, but cyclical demand weakness and price competition overwhelm any technology benefits today.

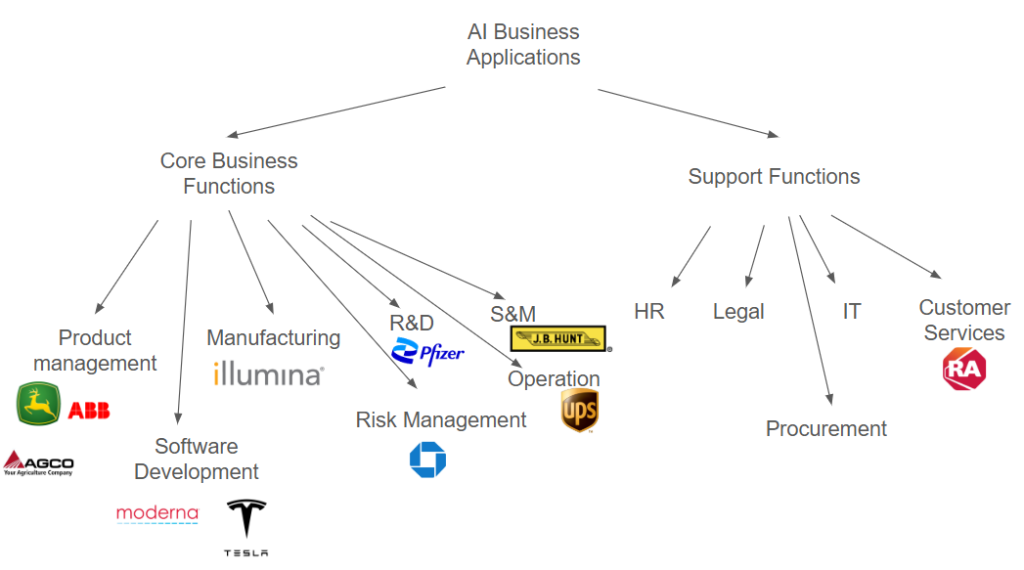

What are the key patterns separating AI winners from losers?

After examining 20+ companies across six sectors, clear patterns emerge explaining why logistics and banking extract measurable value while other sectors struggle.

AI delivers measurable ROI fastest in industries with four characteristics:

Massive data volumes: JPMorgan processes billions of data points daily. UPS handles millions of packages, generating continuous optimization opportunities.

High-frequency decisions: Route optimization happens thousands of times per day. Trading and fraud detection require split-second choices, creating immediate value capture.

Immediate feedback loops: Results are visible within hours or days, not years. UPS knows within 24 hours if route optimization improved efficiency. Banks see fraud prevention results instantly.

Digital-first operations: No need to retrofit 100-year-old factories or wait for drug trials. Software changes deploy across operations immediately.

By contrast, agriculture equipment, automotive manufacturing, and drug discovery involve characteristics that delay or prevent AI ROI:

Long development cycles measured in years, not days. Physical constraints where algorithms cannot accelerate production or shipping. Regulatory approval processes where the FDA doesn’t care about AI model sophistication. Cyclical demand that overwhelms efficiency gains during downturns.

What’s the investment strategy for non-tech AI exposure?

The counter-intuitive play isn’t chasing AI infrastructure buildout – it’s identifying companies where AI already extracts documented value today.

For growth investors focused on current margin expansion:

J.B. Hunt demonstrated platform-driven margin expansion with 18% earnings beat and 8% operating income growth to $242.7 million. Customer retention at 95% with 11% year-over-year volume growth indicates sustainable competitive advantages.

JPMorgan Chase is building competitive moats through AI that will be difficult to replicate, with 20% revenue growth in wealth management and $1.5 billion fraud prevention demonstrating monetizable capabilities.

UPS shows that operational AI generates hundreds of millions in annual savings ($350+ million documented) with a clear path to international expansion.

For value investors seeking cyclical recovery plays:

The agriculture equipment sector (John Deere, AGCO, CNH) presents a contrarian bet: technology is proven and deployed, but stocks are beaten down by cyclicality. When the agricultural cycle turns, these companies will have structurally lower cost bases than in previous cycles.

For tech investors requiring reality checks:

Even Tesla, with Elon Musk’s AI obsession and massive investment, can’t AI its way out of a price war. Operating margins collapsed from 16.8% to 7.2% despite a 400% AI training expansion. AI is a tool, not a business model, that overcomes fundamental industry challenges.

What’s the bottom line for AI investing beyond tech?

AI is transforming real industries—but not evenly, not quickly, and not always profitably. The financial results separate hype from reality across sectors.

Only logistics and banking show clear margin expansion today, with documented savings in hundreds of millions of dollars and measurable revenue growth. These sectors combine massive data volumes, high-frequency decisions, immediate feedback loops, and digital-first operations, enabling rapid AI value extraction.

Three sectors show moderate progress: Pharmaceuticals demonstrate cost discipline and operational efficiency (Pfizer $4 billion savings, Illumina 22.6% margins). Agriculture equipment proves technology effectiveness, but cyclical collapse overwhelms benefits. Industrial automation shows mixed results with ABB performing well, but the sector is facing demand headwinds.

Two sectors show weak current impact: Automotive (Tesla margins collapsing despite AI leadership) and biotech (Moderna losing billions despite AI-native operations) demonstrate that massive AI investment cannot overcome fundamental industry challenges like price wars and revenue cliffs.

For investors, the most compelling non-tech AI opportunities aren’t the ones promising to revolutionize everything—they’re companies quietly deploying AI to eliminate waste, reduce costs, and improve decision-making without the hype. J.B. Hunt’s 18% earnings beat and JPMorgan’s 20% wealth management growth matter more than promises of future transformation.

The revolution isn’t happening in data centers. It’s happening in delivery trucks, saving 100 million miles per year, bank trading floors preventing $1.5 billion in fraud, digital freight marketplaces beating earnings by 18%, and cornfields cutting herbicide use by 59%.

But the financial results reveal an uncomfortable truth: most companies are in the investment phase, with AI benefits years away or overwhelmed by cyclical pressures. After all, it’s easier to save $300 million optimizing truck routes than to invent AGI.

QA

Q: Why aren’t tech companies like NVIDIA and Microsoft in this analysis? A: This article focuses on AI adoption in traditional industries rather than AI infrastructure builders. For tech sector AI investments, see our comprehensive guide “How to Invest in AI“.

Q: Which non-tech sectors show the clearest AI ROI today? A: Two sectors show documented margin expansion: logistics (UPS $350M+ annual savings, J.B. Hunt 18% earnings beat) and banking (JPMorgan $1.5B fraud prevented).

Q: What’s the biggest misconception about AI investing outside tech? A: That heavy AI investment automatically leads to better margins. Tesla invested massively in AI but saw operating margins collapse from 16.8% to 7.2%. Moderna built an AI-native company but lost $3.6B. AI is a tool, not a business model that overcomes fundamental industry challenges.

Q: What’s the difference between AI that saves costs versus AI that grows revenue? A: Cost-saving AI (UPS route optimization, Pfizer operational efficiency) is defensive and easier to measure but has natural limits. Revenue-growing AI (JPMorgan’s Coach AI driving 20% sales growth, J.B. Hunt’s platform creating new business) is offensive and more valuable but harder to achieve. Only logistics and banking show significant revenue-growing AI today.

Q: What are the key companies to watch in non-tech AI adoption? A: Here’s the table with breakdown by sector and current AI impact:

| Ticker | Sector | AI Thesis | AI Impact on Business |

|---|---|---|---|

| JPM | Banking | $17B tech budget ($1.3B for AI), 450+ AI use cases, LLM Suite for 250K employees, Coach AI, fraud detection, coding assistants | Big |

| UPS | Logistics | ORION AI route optimization (saving $350M+ annually, 185M miles, 100K metric tons CO2), MeRA generative AI for customer service (52K daily emails, 50% faster resolution), predictive maintenance (30% downtime reduction), smart warehousing with robotics | Big |

| JBHT | Logistics | J.B. Hunt 360° digital marketplace platform connecting shippers with 1M trucks (1/3 of market), Google Cloud partnership for predictive analytics and ML, real-time capacity optimization, Logistics Venture Lab for AI-driven startups | Big |

| DE | Agriculture | See & Spray computer vision technology, autonomous tractors, precision agriculture reducing herbicide use by 59% average | Moderate |

| AGCO | Agriculture | $2B investment in Trimble agriculture business (PTx), precision ag targeting $2B sales by 2029, technology adoption rate increased from 20% to 70% | Moderate |

| TRMB | Agriculture | GPS technology, farm management software, contributed precision ag business to AGCO JV, retained 15% stake for $3B value | Moderate |

| PFE | Pharma | OncoScout AI platform for cancer drug discovery, Charlie AI for internal ops, targeting 25-30% R&D probability improvement, AI-driven clinical trials | Moderate |

| ILMN | Genomics/MedTech | AI/software platform for genomic data analysis, NovaSeq X sequencing platform, targeting margin expansion through operational excellence | Moderate |

| ABBNY | Industrial Automation | 80% of robotics offerings integrate AI/advanced software, Omnicore platform, autonomous mobile robots, planning robotics spin-off | Moderate |

| FANUY | Robotics | Industrial robotics with AI integration, precision manufacturing automation | Moderate |

| BAC | Banking | $12B technology budget, AI implementation across operations (limited detail available in search) | Moderate |

| TMO | Life Sciences | Ion Torrent platform, co-dominates NGS market with Illumina, automation solutions | Moderate |

| SU (Euronext) | Industrial Automation | Energy management AI solutions, AVEVA platform with double-digit ARR growth, industrial automation software | Moderate |

| PATH | Software/RPA | Robotic process automation platform, AI-powered automation for enterprises | Moderate |

| CNHI | Agriculture | Precision tech through Raven brand, targeting to double Precision Tech sales to 10% of Ag revenue by 2030, aiming for 16-17% EBIT margins | Weak |

| MRNA | Biotech | mChat AI platform (65% employee adoption), AI across drug design, clinical trials, manufacturing; AI-native company vision | Weak |

| TSLA | Automotive | Cortex AI training cluster, FSD (Full Self-Driving) with 2B+ miles, expanded AI training 400% YoY, AI optimizing manufacturing | Weak |

| ROK | Industrial Automation | Digital twin technology, cybersecurity (Verve), autonomous mobile robots (Clearpath acquisition), cloud-based software | Weak |

| WFC | Banking | $4B ICT spending, AI initiatives underway (limited detail available) | Weak |

| BNTX | Biotech | Acquired InstaDeep for AI-driven drug discovery integration into mRNA therapeutics | Weak |

| PACB | Genomics | Sequencing technology competing with Illumina, AI-enhanced platforms | Weak |

Get Started Today

Ready to elevate your market analysis? Head over to EODHD’s website and explore our solutions. Whether you’re a seasoned investor or a beginner, our high-quality Financial Data APIs are your gateway to more efficient market analysis.

Feel free to contact our support to ask for the current discounts. We would also be happy to assist and guide you: support@eodhistoricaldata.com.