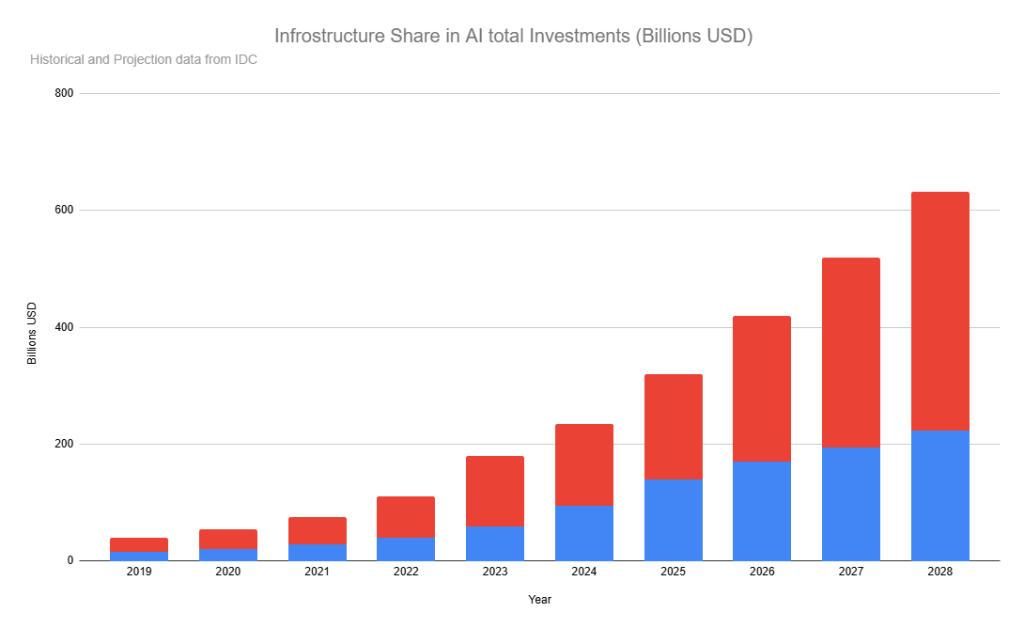

The artificial intelligence investment landscape has reached a critical inflection point in 2025, with AI investments projected to hit $200 billion globally while the broader AI market races toward $1.8 trillion by 2030.

For intermediate investors, the challenge isn’t whether to invest in AI, but how to capture this transformative opportunity while managing the sector’s inherent volatility and premium valuations. The most successful approach combines direct stock exposure, diversified ETF holdings, and strategic infrastructure plays across a carefully allocated portfolio.

Quick jump:

- 1 Which AI stocks should intermediate investors consider?

- 2 What about ChatGPT and other popular AI products?

- 3 Table of popular AI products

- 4 What are the best AI ETFs for diversified exposure?

- 5 How should investors approach AI infrastructure and semiconductor plays?

- 6 How to manage the risks of AI investments?

- 7 What key metrics should investors monitor when evaluating AI companies?

- 8 What’s the bottom line for AI investing in 2025?

- 9 QA

- 10 Get Started Today

Which AI stocks should intermediate investors consider?

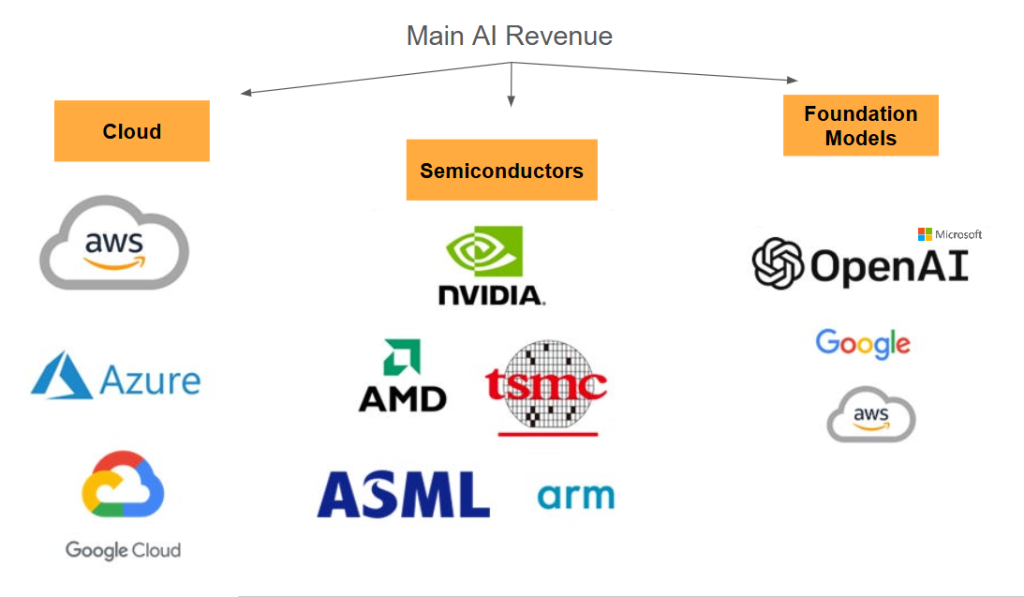

The optimal AI stock strategy focuses on three tiers: established leaders, emerging champions, and infrastructure enablers. For established leaders, focus on NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOGL).

NVIDIA remains the crown jewel despite trading at 29x P/E. High PE could be justified by its 63.85% EBITDA margins and dominant position in AI chips.

Microsoft provides diversified AI exposure through its $10 billion OpenAI investment, Azure cloud dominance, and AI integration across Office 365, generating 36.15% profit margins. Currently Microsoft trades at 34.36x forward P/E while generating $281.7 billion in trailing revenue.

Alphabet offers the most attractive valuation at 21x forward earnings while benefiting from AI integration in search, Google Cloud’s 26% year-over-year growth, and Waymo’s autonomous vehicle technology.

What about ChatGPT and other popular AI products?

ChatGPT (OpenAI) remains private despite $10 billion in annual recurring revenue. While you can’t buy OpenAI stock directly, Microsoft’s $13 billion partnership gives you indirect exposure through MSFT shares. However, this partnership currently generates $1.5 billion quarterly losses for Microsoft, raising questions about near-term profitability.

Claude (Anthropic) stays private with backing from Amazon and Google, making AMZN and GOOGL your best indirect plays.

Midjourney remains privately held with no clear public investment path.

Perplexity AI continues as a private company, though it has attracted significant venture funding.

Table of popular AI products

| Product Name | Company | Ticker/Ownership (Main Investors) | Description |

|---|---|---|---|

| ChatGPT | OpenAI | Private (SoftBank, MSFT) | Leading AI chatbot and language model platform |

| Microsoft Copilot | Microsoft | MSFT | AI assistant integrated across Microsoft products and cloud services |

| Google Gemini | Google (Alphabet) | GOOGL | Google’s AI model and chatbot platform |

| Meta AI | Meta Platforms | META | AI assistant and research platform across Facebook Instagram WhatsApp |

| Claude | Anthropic | Private (GOOGL, CRM) | AI assistant focused on safety and helpfulness |

| DeepSeek AI | DeepSeek | Private | AI assistant and language model |

| Midjourney | Midjourney | Private | One of the earliest widely adopted user-friendly AI image generators now also generates videos |

| Runway ML | Runway ML | Private | AI platform known for easy-to-use interface and robust video generation |

| Kling AI | Kuaishou Technology | 1024.hk | State-of-the-art generative AI platform for professional video and image creation |

What are the best AI ETFs for diversified exposure?

AI-focused ETFs offer professional stock selection while mitigating individual company risk.

The Global X Robotics & Artificial Intelligence ETF (BOTZ) leads with $2 billion in assets under management, 0.68% expense ratio. Diversified holdings include NVIDIA (11.78%), ABB Ltd (9.04%), and Fanuc Corp (7.74%).

For risk-adjusted returns, the ROBO Global Robotics & Automation ETF (ROBO) demonstrates superior Sharpe ratio performance (0.86 vs. BOTZ’s 0.58) despite a higher 0.95% expense ratio. ROBO provides better geographic diversification with 46% US exposure, 19.6% Japan, and 11.5% Eurozone holdings, plus a 0.49% dividend yield.

The ARK Innovation ETF (ARKK) appeals to aggressive growth investors 34.79% year-to-date returns in 2025. However, its high beta of 2.14 and historical volatility (-66.97% in 2022) make it suitable only for risk-tolerant portfolios.

How should investors approach AI infrastructure and semiconductor plays?

The most compelling AI infrastructure opportunities lie in companies providing essential services rather than competing directly in AI applications.

Taiwan Semiconductor Manufacturing (TSM) exemplifies this approach. TSMC controls 90% of advanced chip manufacturing, enabling all advanced chip designs. With record 2024 revenue up 33.9% year-over-year and operating margins exceeding 40%, against an industry average of 14%.

Broadcom (AVGO) represents another infrastructure winner. AVGO AI revenue quadrupled to $2.3 billion in Q3 2024 and now represents 35% of semiconductor revenue. The company’s 60% EBITDA margins and critical role in AI data center networking create substantial competitive moats.

Memory companies represent the strongest near-term opportunity. SK Hynix has overtaken Samsung as the #1 DRAM maker (36% market share) and controls over 70% of the HBM(High Bandwidth Memory) market, delivering record Q4 2024 profits of $5.6 billion. Micron(MU) projects HBM revenue growth from “several hundred million dollars” in 2024 to “multiple billions” in 2025. Meanwhile, Samsung struggles with HBM3E qualification issues, creating market share shifts that favor competitors.

Cloud infrastructure provides additional diversified exposure through Amazon Web Services, Microsoft Azure, and Google Cloud Platform, with 19%, 33% and 35% corresponding growth rates. These platforms benefit from enterprise AI adoption regardless of which specific AI applications succeed.

Data center REITs offer another defensive approach. Digital Realty Trust (DLR) provides 2.7% dividend yield while analysts project 8% revenue growth in 2025. Equinix (EQIX) has delivered 22+ consecutive years of quarterly revenue growth and positions itself for AI low-latency inference workloads.

How to manage the risks of AI investments?

Position sizing becomes critical given AI stocks’ high correlations during market stress (0.7-0.8+) and elevated beta coefficients (1.2-1.5x).

Dollar-cost averaging proves particularly effective for AI investments given the sector’s volatility. Monthly systematic investments help smooth entry points while taking advantage of price fluctuations. Otherwise, lump-sum investors will have timing challenges for their portfolio sizing.

What key metrics should investors monitor when evaluating AI companies?

Successful AI investment evaluation requires monitoring both traditional financial metrics and AI-specific indicators. Traditional metrics include revenue growth consistency, path to profitability timelines, and R&D spending intensity.

AI-specific indicators focus on competitive moats: proprietary technology strength, data asset quality and exclusivity, model performance improvements, and enterprise customer retention rates.

Market timing indicators include AI sector relative strength index monitoring, correlation breakdown analysis, and sentiment shifts measured through institutional investment flows. The sector typically outperforms during early economic recovery phases and low-interest-rate environments.

What’s the bottom line for AI investing in 2025?

The AI investment opportunity in 2025 rewards strategic positioning over speculative betting. By focusing on established leaders, maintaining disciplined allocation limits, and emphasizing infrastructure over pure-play speculation, intermediate investors can capture AI’s transformative growth while managing inherent risks.

The sector’s evolution from experimental technology to enterprise necessity creates compelling long-term opportunities for investors. Where success comes from building diversified exposure across the AI ecosystem rather than betting on individual winners.

QA

Q: Can I buy ChatGPT stock? A: No, OpenAI (ChatGPT’s maker) is private, but you can get exposure through Microsoft stock (MSFT) which invested $13 billion in OpenAI.

Q: What’s the easiest way to invest in AI? A: Buy an AI-focused ETF like BOTZ or ROBO for instant diversification across multiple AI companies.

Q: What’s the difference between AI stocks and regular tech stocks? A: AI stocks have higher growth potential but also higher volatility (beta of 1.2-1.5x) and premium valuations compared to traditional tech.

Q: What’s the biggest risk with AI investing? A: AI stocks move together during market stress (0.7-0.8 correlation), so diversification within the sector provides limited protection.

Q: Should I invest in AI infrastructure or AI applications? A: Infrastructure companies (NVIDIA, TSMC) have more predictable revenue streams than application companies competing for market share.

Q: What stocks to pay attention to? A: Here is a table with the biggest players in AI:

| Ticker | Position | Investment Thesis | Market Cap ($Mln) |

|---|---|---|---|

| NVDA | Core Infrastructure | Dominates AI training chips with 90% market share in data center GPUs, 63.85% EBITDA margins, and strong moat through CUDA ecosystem | 438,513.43 |

| MSFT | Cloud Infrastructure | Diversified AI exposure through $10B OpenAI investment, Azure dominance, and AI integration across Office 365 with 36.15% profit margins | 374,825.03 |

| AAPL | Edge AI Hardware | AI integration in devices through Siri improvements, on-device processing, and new AI features across iPhone/Mac ecosystem | 337,114.54 |

| GOOGL | Cloud Infrastructure | Most attractive valuation at 21x forward earnings with AI integration in search, Google Cloud 26% YoY growth, and Waymo autonomous vehicles | 252,493.90 |

| AMZN | Cloud Infrastructure | AWS market leader with $107.6B revenue, planning $100B AI capex in 2025, though growth trails Microsoft Azure at 18-19% | 243,095.73 |

| TSM | Manufacturing Infrastructure | Controls 90% of advanced chip manufacturing with record $75.9B 2024 revenue, 40%+ operating margins, critical AI chip foundry | 122,189.22 |

| ASML | Manufacturing Equipment | Monopoly in EUV lithography equipment essential for advanced AI chip production, no real competitors in cutting-edge processes | 29,665.37 |

| AMD | Semiconductor Infrastructure | Competing with MI300 series AI accelerators, growing data center GPU business as alternative to NVIDIA chips | 26,510.72 |

| MU | Memory Infrastructure | High-bandwidth memory critical for AI training, benefits from supply-demand imbalances and AI’s massive memory requirements | 13,028.91 |

| AMAT | Manufacturing Equipment | Leading wafer fabrication equipment with $28.6B TTM revenue, 19.1% market share in critical AI chip manufacturing | 12,999.67 |

| MRVL | Semiconductor Infrastructure | Data processing units and connectivity solutions for AI infrastructure, custom silicon development | 6,289.75 |

| DLR | Data Center REITs | Data center REIT with 2.7% dividend yield, benefits from AI infrastructure demand with 8% projected revenue growth | 5,760.68 |

| ASX | Advanced Packaging | ASE Technology benefits from TSMC CoWoS capacity overflow, advanced packaging assembly and test services | 2,148.52 |

| ARKK | AI ETF | ARK Innovation ETF with 34.79% YTD returns, high beta 2.14, suitable for aggressive growth investors only | 804.00 |

| MKSI | Advanced Packaging | Enables next-generation semiconductor packaging with 47.6% gross margins, serves critical supply chain role in chiplet disaggregation | 713.36 |

| BOTZ | AI ETF | Global X Robotics & AI ETF with $2B AUM, 0.68% expense ratio, diversified AI and robotics exposure | 286.00 |

| ROBO | AI ETF | ROBO Global Robotics ETF with superior 0.86 Sharpe ratio, 0.95% expense ratio, better geographic diversification | 108.00 |

Get Started Today

Ready to elevate your market analysis? Head over to EODHD’s website and explore our solutions. Whether you’re a seasoned investor or a beginner, our high-quality Financial Data APIs are your gateway to more efficient market analysis.

Feel free to contact our support to ask for the current discounts. We would also be happy to assist and guide you: support@eodhistoricaldata.com.