Nexus Trade started as a passion project by Austin Starks, a software engineer and algorithmic trader who wanted a platform where trading ideas could be expressed simply in natural language and instantly transformed into backtested strategies. While pursuing his master’s degree at Carnegie Mellon, Austin observed that existing platforms posed significant barriers: either requiring complex coding skills or forcing users to navigate cumbersome interfaces. Determined to simplify this, he envisioned a more intuitive approach powered by AI and founded Nexus Trade.

“I wish there was a platform where I could just describe my strategy and it was executed for me,” Austin recalls. This simple idea became the backbone of Nexus Trade.

Watch the full interview with Austin Starks, Founder & CEO of NexusTrade.io

Early Growth and Data Challenges

Initially, the platform attracted its first users organically through Austin’s posts on Reddit and Medium, where he shared his development journey openly. However, as the user base grew, challenges around data quality and consistency became apparent. Austin needed a provider that could offer extensive historical data, fundamental financial indicators, and flexible API access — all critical for enabling the natural-language driven AI features Nexus Trade aimed to deliver.

“When I tried other vendors, data quality and coverage were lacking — it became clear I needed an institutional-grade dataset to build what I envisioned,” he explains.

Why EODHD?

EODHD emerged as the ideal partner, notably for its broad API coverage including end-of-day prices, fundamentals such as net income and shares outstanding, along with index membership changes over time. The integration process was straightforward and fast, thanks to detailed documentation and the availability of strong developer support around the clock.

“Integrating EODHD was incredibly simple,” Austin says. “It was as easy as copying example requests, inserting my API key, and immediately accessing the data I needed. The support team is responsive and reliable — that makes all the difference when you’re building a startup.”

Data and Features Powering Nexus Trade

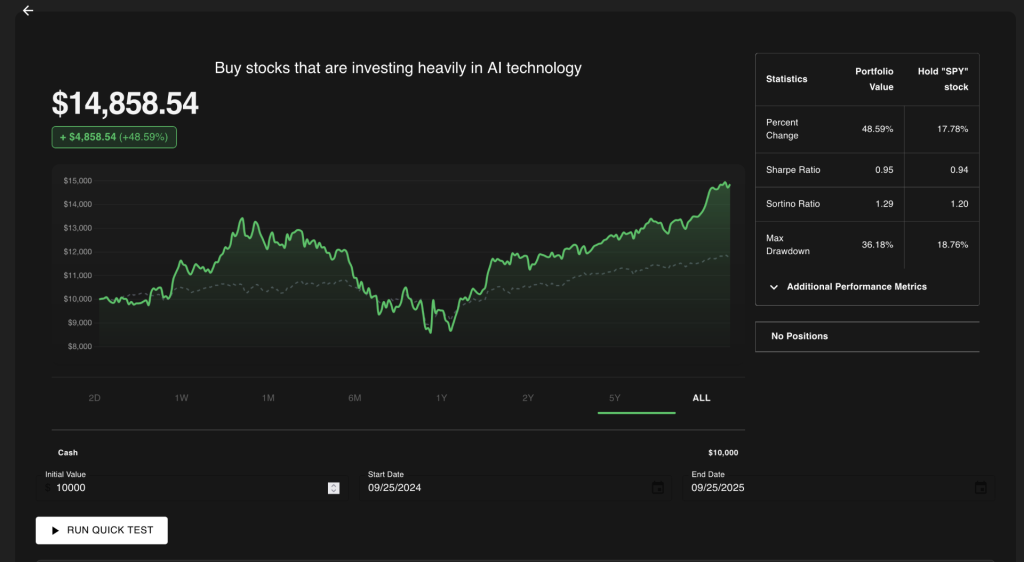

Leveraging EODHD’s datasets, Nexus Trade computes essential metrics on the fly — combining data from several key API endpoints: Fundamentals API (including net income and shares outstanding), End of Day API historical prices, and Index Constituents data. Austin combines these to calculate market capitalization, earnings per share, and track index constituent changes over time. The platform also integrates this index data to power dynamic stock screeners accessible through simple natural-language queries. For example, users can prompt the AI to “show biotech stocks profitable for the last four quarters” without complex filtering or coding.

“Our AI chat is a game changer,” Austin shares. “You just tell it what stocks you want to see—or describe your strategy in plain English—and the system builds and backtests that strategy for you. It’s like having a financial analyst at your fingertips.”

This ease of use quickly translated into user growth, which shifted from linear to exponential once AI-based natural language features launched.

Another key benefit noted by Austin was dramatically improved backtesting efficiency.

“We recently sped up our backtesting engine by 99 times. That performance gain means faster experiments and quicker delivery of new features for our users.”

This rich data foundation, combined with intuitive AI interaction and optimized performance, has firmly positioned Nexus Trade in a competitive fintech landscape.

Advice for Startups and Future Plans

From his experience, Austin offers practical advice to startups:

“Focus on building and releasing one feature at a time. Share your progress publicly to attract early users and feedback. Optimize your API usage to manage costs. And above all, don’t rush—high quality and patient iteration trump speed.”

Looking ahead, Austin plans to incorporate Intraday data feeds from EODHD for faster backtesting and live trading capabilities, as well as utilize more fundamentals endpoints to compute additional indicators.

“We’re excited about what’s coming next,” Austin says. “Intraday data, live trading, and automated idea generation will make our platform even more powerful — and accessible to more traders.”

For fintech founders seeking reliable, flexible, and comprehensive financial data APIs, EODHD provides an enabling foundation to innovate quickly and maintain focus on delivering differentiated products—just as it has for Nexus Trade.

Start building your fintech innovation today — talk to our team.