Is AI the next internet — or the next Pets.com?

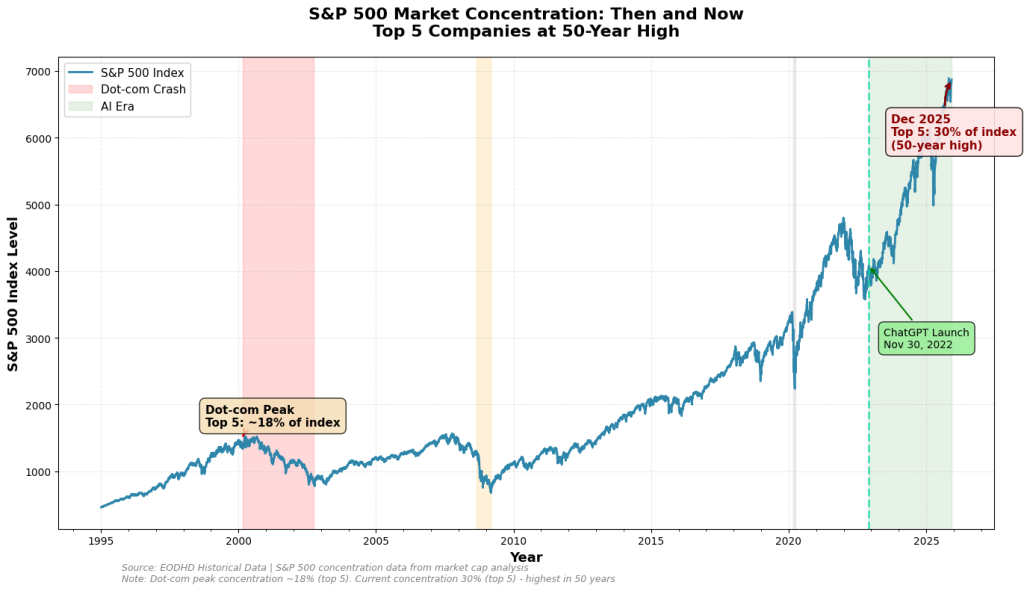

ChatGPT launched in November 2022. Tech CEOs made promises that would shame even the dot-com era. Within months, $600 billion flooded into AI companies. Fast forward to December 2025: Sam Altman admits we’re in an AI bubble. Michael Burry—who called the 2008 crash—is shorting Nvidia. Markets keep climbing.

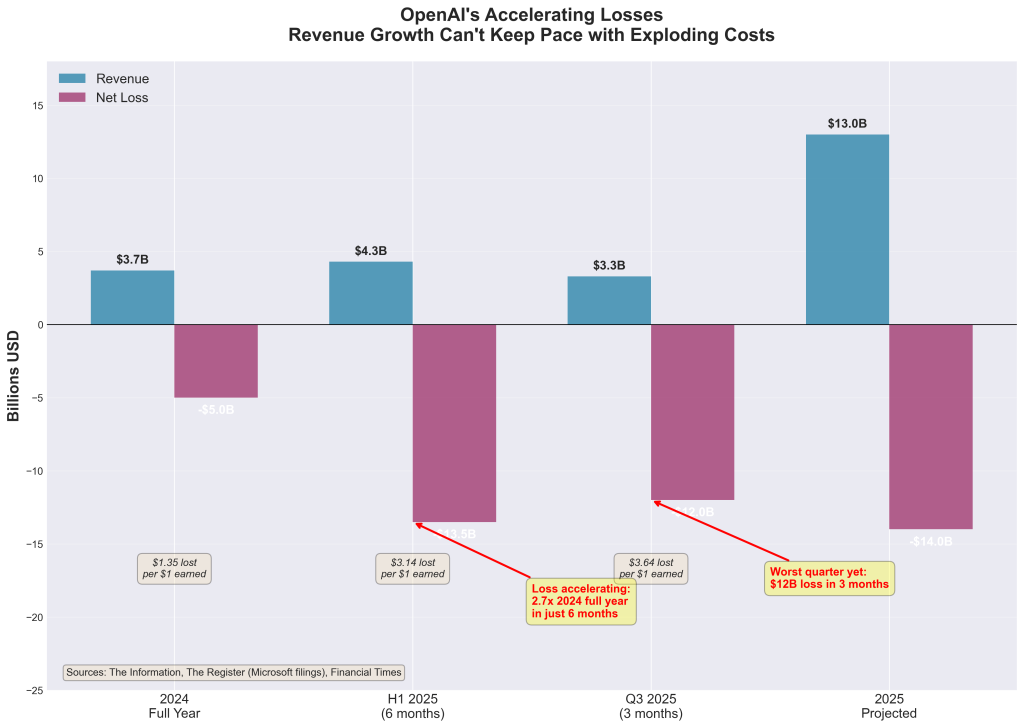

The numbers tell a strange story. The top 5 S&P 500 companies now represent 30% of the index—the highest concentration in 50 years. OpenAI’s losses hit $13.5 billion in just six months while earning $4.3 billion. That’s $3.14 lost for every dollar earned. 95% of enterprise AI projects fail to deliver returns.

Yet here’s the paradox: professional fund managers know it’s overvalued, but they’re doubling down anyway. This isn’t ignorance. It’s a coordination game where everyone knows the music will stop, but nobody wants to leave first.

Quick jump:

The Dot-Com Comparison: Valid or Overblown?

What’s Different (The Bull Case)

Today’s AI leaders are established tech giants with real cash flows:

- Real Revenue: The Magnificent Seven generated $1.6 trillion in 2025. S&P 500 companies reported 13.4% profit growth in Q3—the fourth consecutive quarter of double-digits.

- Profitable Cores: Microsoft, Google, Amazon fund their AI investments from operating cash, not debt. Microsoft beat expectations despite $93.7 billion in AI spending plans. Google posted its first $100 billion quarter.

- Actual Demand: ChatGPT has 800 million weekly users. Enterprises are signing billion-dollar contracts—Oracle holds $455 billion in AI-related backlog.

The S&P 500 trades at 23x forward earnings. High, but not the 52x levels from the dot-com peak in 2000.

What’s Similar (The Bear Case)

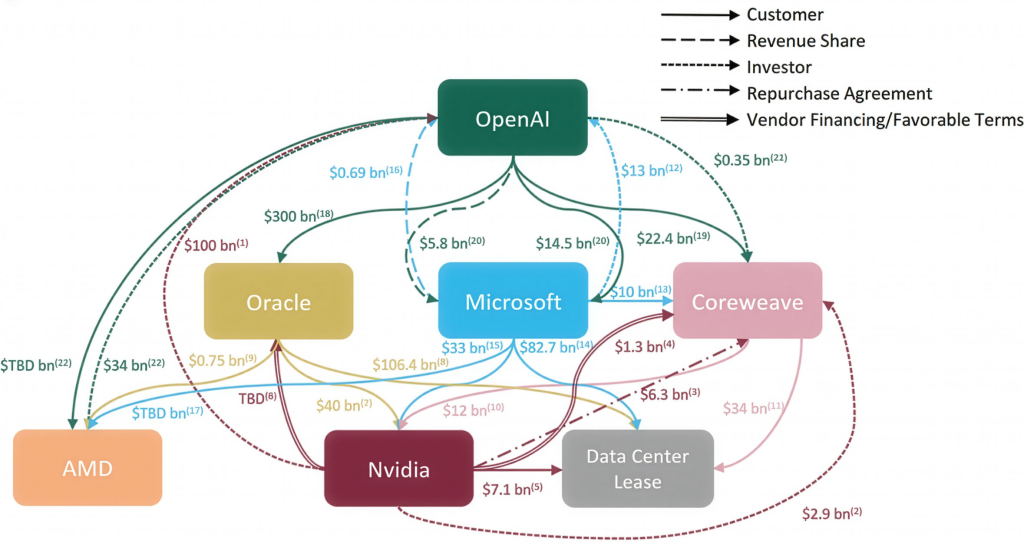

Circular Financing: In the late 1990s, telecom suppliers gave billions in vendor financing to WorldCom and Sprint to buy equipment. When the bubble burst, these companies collapsed. We’re seeing the exact same pattern today.

The Numbers Don’t Add Up:

- Tech companies are spending $400-500 billion annually on AI infrastructure

- Consumers spending $12-15 billion per year on AI services

- That’s a 30:1 spending-to-revenue gap

Apollo Global Management warns that AI valuations look worse than the dot-com bubble. The AI bubble is estimated to be 17 times larger than the dot-com and four times bigger than the 2008 mortgage crisis.

Most telling is that Sam Altman himself admitted that he believes we’re in an AI bubble. When the CEO of the industry’s flagship company acknowledges it, something unprecedented is happening.

Case Study: OpenAI

The Promise

OpenAI is valued at $500 billion after its March 2025 funding round—the largest private tech fundraise in history at $40 billion. This makes it worth more than Walmart or JPMorgan Chase.

The Reality

First Half 2025:

- Revenue: $4.3 billion

- Net Loss: $13.5 billion

- Spending: $3.14 for every $1 earned

Third Quarter 2025: Microsoft’s filing shows OpenAI lost $11.5 billion in Q3 alone—nearly equal to the entire first-half loss.

Full Year 2025 Projections:

- Revenue: ~$12-13 billion (Sam Altman: “well more than $13B”)

- Expected Loss: $14+ billion

- Microsoft inference costs alone: $8.7 billion for nine months

The Path Forward:

- Projected losses through 2028: $115 billion cumulative

- Expected break-even: 2029-2030

- 2030 revenue target: $200 billion (15x growth in 5 years)

Yet OpenAI has committed to spending:

- $300 billion with Oracle over five years

- $200 billion on Nvidia chips

- $100 billion on AMD processors

The Circular Financing Web

How is this possible? The same money travels in circles:

- Nvidia invests $100 billion in OpenAI

- OpenAI commits $200 billion to Nvidia chips

- Oracle builds data centers for OpenAI ($300 billion)

- Oracle buys Nvidia chips with that money

- Nvidia invests proceeds back in OpenAI

- Microsoft funded $11.6 billion of its $13 billion commitment

Michael Burry calls this out on X: “True end demand is ridiculously small. Almost all customers are funded by their dealers.” He asks pointedly: “OpenAI is the linchpin here. Can anyone name their auditor?”

Goldman Sachs analysis shows 75%+ of OpenAI’s operating costs depend on external funding.

The Usage Paradox

OpenAI achieved unprecedented adoption with its 800 million weekly active users. Yet only 40 million (5%) pay for subscriptions at $20/month. This generates roughly $9.6 billion annually from consumer subscriptions—about 70% of OpenAI’s revenue.

ChatGPT is the most successful AI product launch in history and a product where 95% of users expect it to be free.

The Verdict: Revolutionary technology wrapped in unsustainable financial engineering.

Case Study: Nvidia

The Success Story

Nvidia stock surged 1,600% from ChatGPT’s launch through mid-2024. The company hit $4 trillion market cap in July 2025, with revenues exploding from $26 billion in 2023 to a projected $321 billion by 2028.

The Business Model

Unlike OpenAI, Nvidia’s margins are exceptional:

- Operating margins: 50-60%

- GPUs selling for $30,000-40,000 each

- Every dollar of revenue generates substantial profit

The Growing Concerns

Customer Concentration: Microsoft accounts for ~20% of Nvidia’s revenue as of fiscal Q4 2025. The company has equity stakes in most major customers—OpenAI, CoreWeave, others—creating circular dependencies.

When you sell shovels during a gold rush, you win—until the gold rush ends.

The DeepSeek Shock (January 2025): Chinese company DeepSeek launched a model comparable to GPT-4 but trained for a fraction of the cost. Nvidia lost $589 billion in market value in a single day—the largest one-day loss in American corporate history.

The market realized: efficiency improvements are as dangerous to Nvidia as outright AI failure. If models train with 90% fewer chips, Nvidia’s revenue projections collapse even if AI succeeds.

Michael Burry’s Short Position: The investor who called 2008 is now betting against Nvidia. In December 2025, he argued the stock will decline following the pattern where stock peaks come before capital expenditure peaks—just like dot-com when Cisco collapsed.

The Hyperscaler Threat

Microsoft, Google, and Amazon are all developing proprietary AI chips to reduce Nvidia dependency. These won’t replace Nvidia entirely, but could cut purchases 20-40% over 3-5 years—devastating for a company whose growth assumes continued exponential increases.

The Verdict: Real business, real profits, spectacular margins—but dangerously exposed to efficiency improvements, hyperscaler vertical integration.

Case Study: GitHub Copilot

GitHub Copilot shows AI’s practical problem perfectly. It’s one of the most useful, widely adopted AI tools available—beloved by developers. And it’s a money-losing disaster.

Current Status (2025):

- Pricing: $19/month (consumer) / $39/month (business)

- Cost to Microsoft: $30+ per user per month

- Loss per consumer customer: $11+ monthly

This is one of the most popular and genuinely productive AI tools available. Developers love it. It demonstrably improves coding speed. Every single paying customer generates a monthly loss.

Why Microsoft Doesn’t Care

They subsidize Copilot because:

- Developers using Copilot depend on Microsoft’s development tools

- Copilot integrations push enterprise customers toward Azure

- Prevents competitors from winning the developer AI race

- If they figure out better economics later, they will have a dominant market share

This is the hyperscaler advantage: using profits from one business to subsidize AI losses that strengthen the overall moat.

The Broader Pattern

MIT researchers found 95% of corporate generative AI projects fail to generate meaningful financial returns as of mid-2025. Average cost savings from AI: about 27%. But this hasn’t translated into bottom-line profits because implementation costs, integration complexity, and computing costs exceed savings.

Goldman Sachs tested AI tools internally and found they cost six times more than having humans do the work. Jim Covello, Goldman’s head of equity research: “AI technology is exceptionally expensive, and to justify those costs, the technology must solve complex problems, which it isn’t designed to do.”

The Verdict: Product-market fit without business model fit. Copilot proves AI can be useful and popular—but not that it can be profitable.

The Power Crisis

Here’s what everyone is missing: the constraint that will likely determine whether this bubble deflates slowly or pops violently isn’t failed products or revenue disappointments. It’s electricity.

The Crisis Is Materializing

Demand:

- US data center power needs will triple from 2024 to 2030

- Growing from 61.8 GW (2025) to 134.4 GW (2030)

- Data centers will consume nearly 10% of US electricity by decade’s end

Supply Reality:

- Power constraints extend data center construction by 2-6 years

- Critical equipment like transformers: 4-5 year lead times

- Grid connection requests: 4-7 year wait in key regions

- Data center vacancy rates: record 2.3% (Northern Virginia <1%)

December 2025 Wake-Up Call:

CoreWeave—with $55.6 billion in revenue backlog—slashed 2025 capex guidance by 40%. The reason? Delayed power infrastructure delivery.

Oracle’s CEO confirmed they’re “waving off customers” despite $455 billion in backlog because they can’t secure adequate power fast enough.

This is the moment the market realized that you can have capital, customers, and contracts—but if you can’t get electricity, none of it matters.

The Math Doesn’t Work

Between 2025-2030, data centers need an additional ~73 GW of reliable, 24/7 power.

Planned renewable additions: 32.5 GW solar capacity in 2025 alone

The problem: Solar only works during the day. Data centers need 24/7 baseload power.

Planned reliable baseload additions: ~6-8 GW (natural gas plus maybe a few nuclear restarts)

Gap: ~65 GW shortfall

This is like needing 65 new nuclear reactors in five years. The US has 94 commercial reactors in total. The most recent one took 43 years to build.

The Nuclear Mirage

Tech companies are betting on nuclear:

- Microsoft: Three Mile Island restart (target 2028, 835 MW)

- Amazon: Four small modular reactors (target 2030+)

- Google: Kairos Power SMR partnership (target 2030+)

The problem? Small modular reactors don’t exist commercially. They’re in development with no operating deployments. Sharon Squassoni, nuclear safety expert: “They’re going to find out pretty quickly that it takes way too long and it’s way too expensive.”

Even the Three Mile Island restart won’t be operational until 2028 at the earliest.

The Cost Impact

In areas near major data centers:

- Wholesale electricity prices up as much as 267% vs five years ago

- Average US residential prices rose 6.5% from May 2024 to May 2025

- Some states: Maine (+36.3%), Connecticut (+18.4%), Utah (+15.2%)

Consumers are already paying for a buildout that can’t be completed.

Why This Changes Everything

The power constraint creates three critical dynamics:

1. Natural Bubble Brake: Can’t over-build if you can’t get power. This prevents the traditional bubble pattern where excess supply swamps demand. CoreWeave’s 40% capex cut is the template—more coming.

2. Consolidation Accelerator: Companies that secured power deals 2-3 years ago (Microsoft, Amazon, Google) now have insurmountable advantages. Late entrants literally cannot compete—there’s no power available.

3. Prevents Catastrophic Pop: Traditional bubbles burst when oversupply meets disappointing demand. But supply can’t exceed physical constraints. This suggests slow deflation rather than sudden collapse.

The Verdict: The power crisis is simultaneously the biggest threat to AI growth AND the factor most likely to prevent a catastrophic market crash.

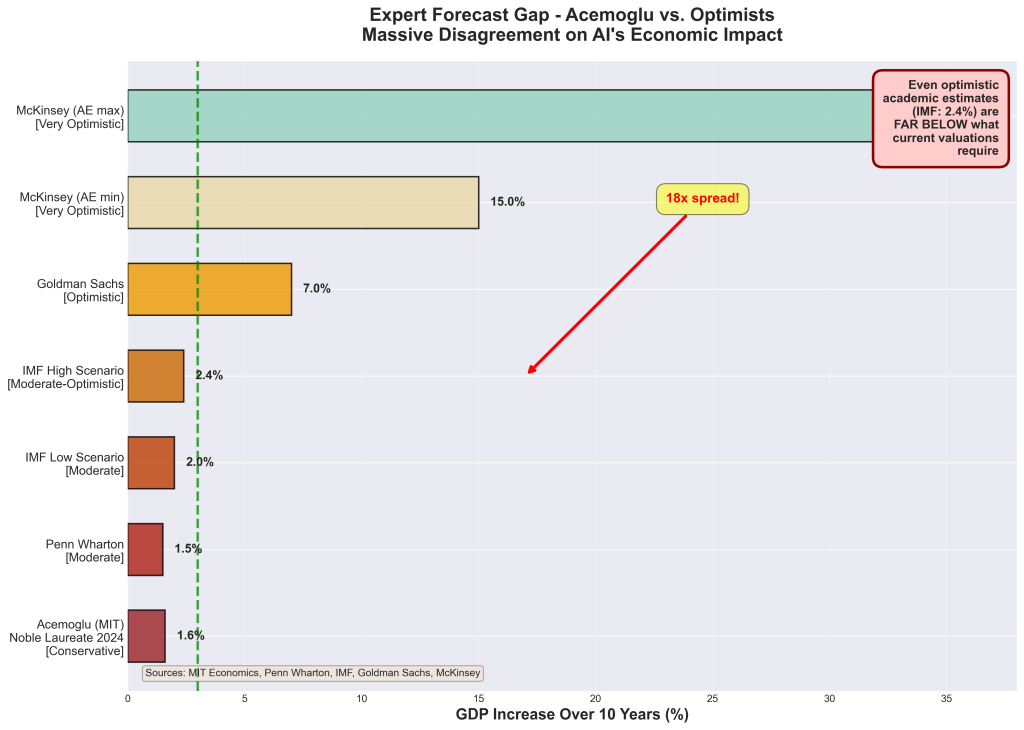

What the Experts Say

The Bear Case: Daron Acemoglu (MIT, 2024 Nobel Laureate)

In “The Simple Macroeconomics of AI,” Acemoglu estimates:

- Total factor productivity increase: 0.66-0.71% over 10 years

- GDP growth: 1.1-1.6% total (over decade, not annually)

- Annual productivity gain: ~0.05 percentage points

Why so modest? Only 5% of tasks can be profitably automated:

- 20% of tasks are “exposed” to AI

- But only 23% of those exposed tasks are profitable to automate

- Result: 4.6% of GDP actually affected

- With 27% average cost savings: 0.046 × 0.27 = 1.24% productivity over decade

“We’re still going to have journalists, financial analysts, HR employees,” Acemoglu explains. “It’s going to impact office jobs about data summary, visual matching, pattern recognition.”

His analysis directly contradicts forecasts claiming AI will double GDP growth.

The Goldman Sachs Report

Goldman’s June 2024 research questioned whether massive AI spending will pay off:

- Finding: “Little to show for” the huge amounts spent

- Jim Covello: “Despite its expensive price tag, the technology is nowhere near where it needs to be for even basic tasks”

- Internal testing: AI tools cost six times more than manual work

Yet Goldman concluded: “Despite these concerns, we still see room for the AI theme to run, either because AI delivers on its promise, or because bubbles take a long time to burst.”

The Bull Case: Goldman Sachs Asset Management

Interestingly, while Goldman’s research division expressed skepticism, their asset management team remains bullish. After meeting with 20 AI companies, they concluded: “Our confidence continues to increase that this technology cycle is real.”

Their argument: Some companies are generating returns from AI, and genuine demand exists for more computing capacity than suppliers can deliver.

Expert Consensus Range

The expert range spans roughly:

- Pessimistic: 0.7% TFP gain over 10 years (Acemoglu)

- Moderate: 1.5-2.4% TFP gain (IMF, Penn Wharton)

- Optimistic: 7% GDP gain (Goldman Sachs)

- Very Optimistic: $17-25 trillion value creation (McKinsey)

Even optimistic cases are far below what current AI valuations imply. For OpenAI’s $500 billion valuation to make sense, AI needs to deliver McKinsey’s very optimistic scenario—and do so quickly.

Conclusion

Here’s the uncomfortable truth both bulls and bears must accept: AI can be transformative technology AND a dangerous bubble simultaneously.

The internet was revolutionary—but that didn’t save investors who bought Pets.com at $11 per share or Cisco at 200x earnings. The technology transformed society. The early investors lost fortunes. Both were true.

Similarly, AI will likely transform knowledge work, enhance productivity, and create trillions in value. But that doesn’t mean today’s valuations are justified or that current winners will capture that value.

Q&A

Q: Is this another “tech bubble will crash” prediction?

A: No. This is “the bubble is real and the technology is real—both can be true simultaneously.” Power constraints prevent both euphoric overbuilding and sudden collapse.

Q: What makes this bubble transparent?

A: Everyone admits it’s overvalued—Sam Altman, Michael Burry, 54% of fund managers—yet they keep buying. It’s a coordination game. Past bubbles collapsed when reality disappointed expectations. This one might deflate slowly because no one is genuinely surprised by the valuations.

Q: What’s the “power constraint moat” thesis?

A: Physics creates a natural brake. CoreWeave cut capex 40% because electricity isn’t available. Oracle is “waving off customers”—$455B backlog but no power to deliver. This prevents catastrophic overbuilding (2000-style fiber glut) but also blocks competitors. Hyperscalers with locked-in power deals win by default.

Q: Why are unit economics broken even for successful products?

A: This isn’t a scaling problem; it’s structural. 95% of enterprise AI projects show no returns. The technology works but the business model doesn’t.

Q: What’s the “circular financing” risk?

A: Microsoft invests $13B in OpenAI → OpenAI buys NVIDIA chips → NVIDIA invests in CoreWeave → CoreWeave buys Oracle cloud → Oracle uses Llama/ChatGPT APIs → Meta funds AI research. Everyone’s revenue comes from everyone else’s investment. When external capital stops flowing, the loop breaks.

Q: What’s the DeepSeek lesson?

A: Efficiency gains are as dangerous as AI failure. When a Chinese startup matched GPT-4 at a fraction of training cost, NVIDIA lost $589B in one day—the largest single-day corporate loss in history. If AI gets dramatically cheaper, the entire capex thesis collapses.

Get Started Today

Ready to elevate your market analysis? Head over to EODHD’s website and explore our solutions. Whether you’re a seasoned investor or a beginner, our high-quality Financial Data APIs are your gateway to more efficient market analysis.

Feel free to contact our support to ask for the current discounts. We would also be happy to assist and guide you: support@eodhistoricaldata.com.