“Sell in May and Go Away” has been a popular saying in the financial world for decades. The strategy suggests that investors should sell their stocks in May, avoid the summer months, and return to the market in November. However, a closer examination of historical data and market dynamics reveals that this strategy may not be as effective as it seems, particularly in the context of US markets. In this article, we will explore the reasons why investors should be cautious about following this adage and discuss alternative approaches to navigating the market during the summer months based on the data for S&P500 index performance for the 1929-2023 period. For global markets you can check a great article “Sell in May and Go Away” Just Won’t Go Away.

You can copy the Google Sheets spreadsheet with the aggregated data for your research.

The EODHD platform’s historical data for the S&P500 was used to assess the performance of the US market for the 1929-2023 period. The EODHD provides simple JSON APIs covering dividend payments, yields, ex-dates, and more for 150,000+ tickers across 70+ worldwide exchanges.

You can also check our template libraries with step-by-step guides for Excel and Google Sheets spreadsheets. Here you’ll find more information on our Ready-to-Go solutions.

Quick jump:

Origins

The phrase “Sell in May and Go Away” has its roots in the United Kingdom, where it was originally coined as “Sell in May and go away, and come on back on St. Leger’s Day.” St. Leger’s Day refers to a horse race held in mid-September, marking the end of the summer holiday season. The saying suggests that investors should sell their holdings in May, enjoy their summer vacations, and return to the market in September.

Historically, the summer months have been associated with lower trading volumes and reduced market liquidity, as many traders and investors take time off for holidays. This reduced market participation has sometimes led to increased volatility and weaker stock performance during this period.

Inconsistent Performance of the “Sell in May and Go Away” Strategy

While some studies have shown that the US stock market has historically underperformed during the summer months, the effect is not consistent across all years. This suggests that the “Sell in May” strategy may not be as reliable as its proponents claim.

Missed opportunities

By selling stocks in May and staying out of the market until November, investors risk missing out on potential gains. If an investor had followed the “Sell in May” strategy from 1929 to 2023, they would have missed out on an average annual return of 2.1% compared to a buy-and-hold approach (Based on S&P500). Over time, these missed opportunities can significantly impact long-term portfolio performance.

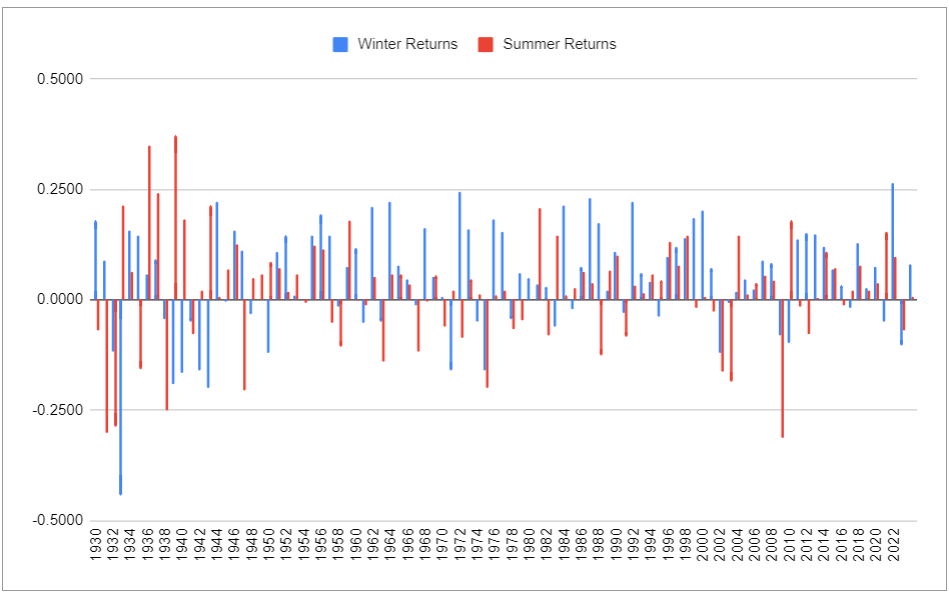

The chart of Annual returns from the “Winter” period from November 1st till April 30, and “Summer” from May 1st till October 31st. From the chart, it’s not clear which period gives better results, and the “Sell in May” strategy starts to look not so clear-cut.

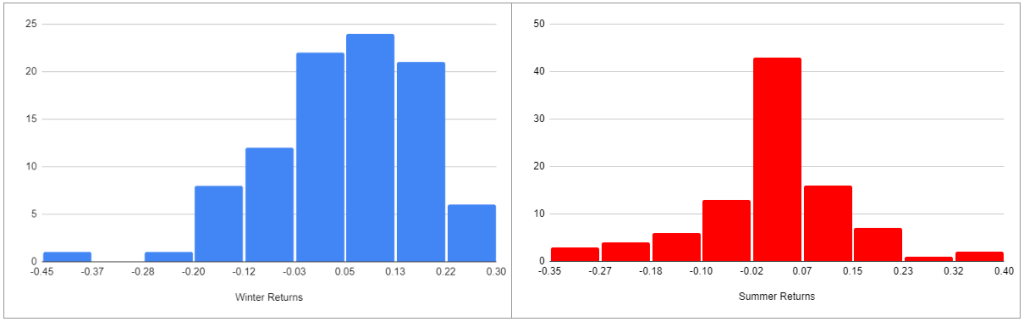

Histograms of Annual Returns distribution for Summer and Winter periods (1929-2023) shows that summer periods contribute to the performance comparable to the Winter. However, Winter periods have higher average return as well as median.

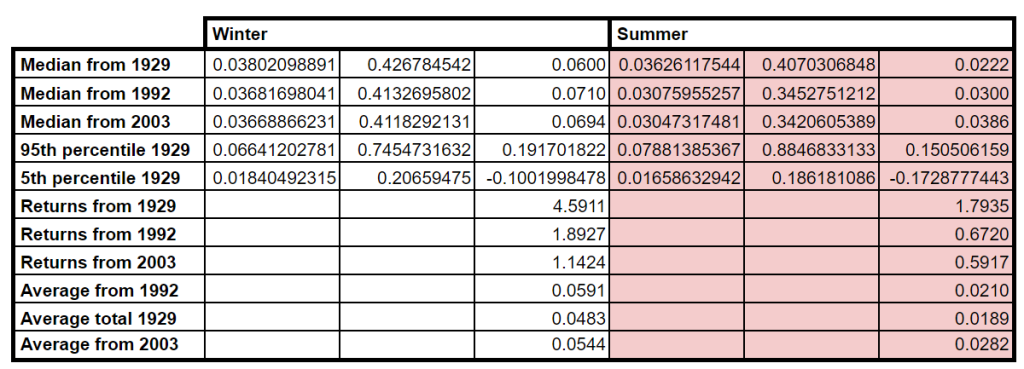

Combined Statistical data shows, that the median of the returns for Summer periods increases through the years, making the difference between periods less pronounced. Contributors to the increase could be the growing IT non-cyclical sector and improvements in trading technologies.

From the above, we can conclude that, Instead of missing out on potential gains from the “Sell in May” strategy, investors could consider maintaining a long-term focus and a well-diversified portfolio and employing dollar-cost averaging to mitigate the impact of short-term market fluctuations.

Changing market dynamics

The “Sell in May” strategy is based on historical observations, but market dynamics have evolved. With the increasing globalization of financial markets, improvements in technology, and the rise of algorithmic trading, traditional seasonal patterns may be less relevant in today’s market environment. Investors should be cautious about relying on outdated assumptions when making investment decisions.

Sector-Specific Considerations

The impact of the “Sell in May” strategy may vary across different sectors. Some sectors, such as consumer discretionary and tourism-related stocks, might be more affected by the summer slowdown. However, other sectors, like healthcare and utilities, may be less impacted. Investors should consider sector-specific factors when evaluating the potential benefits of the “Sell in May” strategy.

Transaction costs and taxes

Frequent trading associated with the “Sell in May” strategy can result in higher transaction costs and potential tax implications. Investors should factor in these costs when assessing the overall effectiveness of the strategy. In some cases, the costs may outweigh the potential benefits of avoiding the summer months.

Conclusion

The effectiveness of the “Sell in May and Go Away” strategy in US markets is not clear-cut. Investors should consider its limitations and explore alternative approaches, such as maintaining a well-diversified portfolio, regularly rebalancing holdings, and making decisions based on fundamental analysis. Consulting with a financial advisor can help investors make informed decisions based on their individual objectives, risk tolerance, and investment horizon. By carefully assessing the “Sell in May” strategy and considering alternative approaches, investors can potentially optimize their investment strategies for navigating US markets throughout the year.

Feel free to contact our support team at support@eodhistoricaldata.com for any questions or current discount offers. We’re happy to assist you through the process of leveraging EODHD’s data to elevate your investment workflow.