As a financial analyst, algotrader, developer of financial products, or private trader, you know the critical role of data quality. Whether you’re crafting investment strategies, conducting market research, or building predictive models, reliable data is essential.

This article examines the risks of using unreliable sources, and the challenges associated with free data. We also explore the benefits of opting for paid financial APIs, ensuring you make informed, accurate decisions.

Read on to discover how to optimize your data for better trading outcomes.

The Risks of Poor Data Quality

Inaccurate or incomplete data can lead to a host of problems for financial analysts. Some of the most significant risks include flawed analysis, where incorrect data results in misinterpretation of market trends, incorrect valuations, and poor investment decisions.

Relying on faulty data can damage an analyst’s reputation as a reliable professional, leading to long-lasting effects on their career and credibility.

Poor data quality can cause substantial financial losses for both individuals and organizations, whether through missed opportunities or misguided investments.

Finally, in some cases, using incorrect data can lead to regulatory violations and potential legal consequences, particularly in industries with strict reporting requirements, such as banking and insurance.

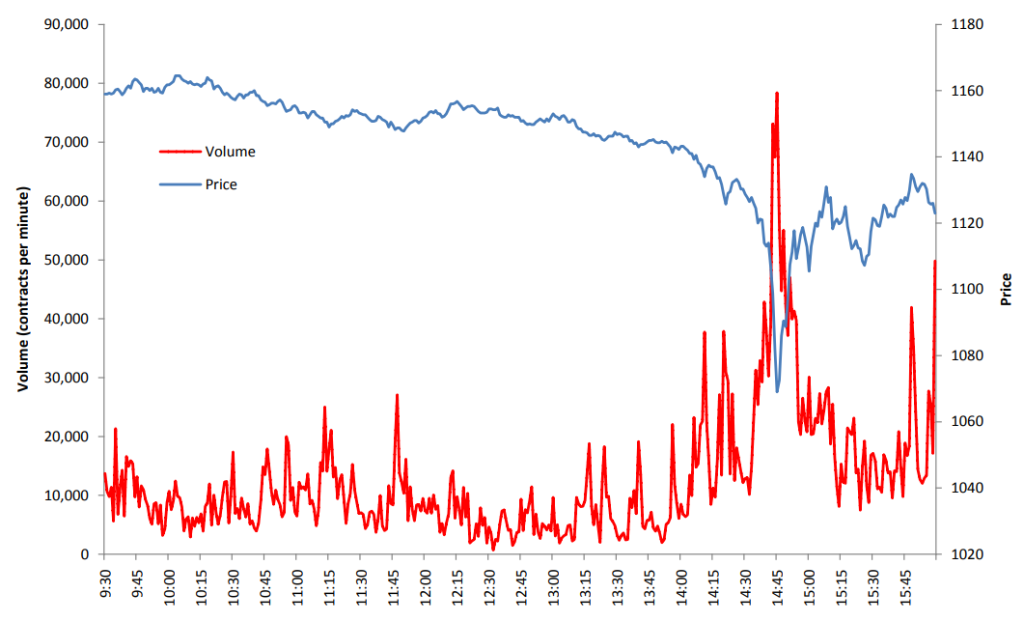

The Flash Crash: A Lesson in Data Quality

“Of final note, the events of May 6 clearly demonstrate the importance of data in today’s world

“Findings Regarding the Market Events of May 6, 2010” SEC & CFTC

of fully-automated trading strategies and systems.”

The Flash Crash, as detailed in the “Findings Regarding the Market Events of May 6, 2010” report by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), was caused by a confluence of factors. Including the use of inaccurate and delayed market data by some participants. This led to a mismatch between executed trade prices and the prices traders believed they were getting. Contributing to the market’s rapid decline and subsequent instability.

The Broader Image of Bad Data

But the Flash Crash is just one example of the impact of bad data. According to a study by Thomas C. Redman, poor data quality costs the U.S. economy around $3 trillion per year. This figure encompasses the direct costs of bad data. Such as lost revenue and increased expenses, as well as indirect costs like reduced productivity and flawed decision-making.

The consequences of bad data extend beyond financial losses. As outlined in Gartner’s “How to Create a Business Case for Data Quality Improvement,” poor data quality can lead to missed opportunities, damaged reputation, and regulatory issues.

In an increasingly competitive and regulated business environment, organizations cannot afford to ignore the importance of data quality.

The Challenges of Free Data Sources

While free financial data sources may seem appealing, they often come with several drawbacks. One major issue is inconsistency, as free data sources may not always provide standardized data formats, making it difficult to integrate and analyze the information effectively.

Additionally, these sources often have a limited scope, offering only a specific set of assets or markets and limited historical data, which can hinder comprehensive analyses.

The reliability of free data sources is also a concern, as they may lack the quality control or verification processes found in paid services, increasing the risk of errors, gaps, or inconsistencies in the data. Moreover, using free data sources typically means you do not have access to dedicated support teams to assist with any issues or questions that arise.

The Benefits of Paid Financial APIs

Investing in a paid subscription to a reputable financial API provider like EODHD, offers several key advantages:

- Data quality:

- EODHD prioritizes data quality and employ rigorous verification and validation processes to ensure the accuracy and reliability of our data.

- Comprehensive coverage:

- EODHD provides access to a wide range of historical data, covering multiple asset classes and markets. This enables you to conduct more thorough and diverse analyses.

- Standardized formats:

- EODHD offer data in standardized formats, making it easier to integrate into your existing workflows and tools.

- Timely updates:

- With a paid subscription, you can expect regular and timely updates to the data. Ensuring that you’re always working with the most current information.

- Dedicated support:

- EODHD also offers dedicated support teams to assist you with any technical issues, questions, or concerns you may encounter.

For a deeper understanding of our data quality assurance methods, check out this article:

Data Processing in Delivering High-Quality Financial Data

At EODHD, we understand the importance of data quality in financial analysis. That’s why we’re committed to providing our users with accurate, reliable, and comprehensive financial data through our API subscriptions.

However, you can use a Free subscription to start with the API. Our rigorous data verification processes, extensive historical coverage, and dedicated support team ensure that you have the high-quality data you need to make informed decisions and succeed in your financial analysis endeavors.

Conclusion

The quality of your financial data is essential to the success of your analysis and the reliability of your results. While free data sources may be tempting, they often come with significant risks and limitations. By investing in a paid subscription to a reputable financial API provider like EODHD, you can ensure that you have access to the accurate, comprehensive, and timely data you need to excel in your financial analysis work. Check the article on EODHD’s data pipeline to deliver reliable data to the end users.

Feel free to contact our support team at support@eodhistoricaldata.com for any questions or current discount offers. We’re happy to assist you through the process of leveraging EODHD’s data to elevate your investment workflow.