I guess you are wondering what Options are, and how they differ from Stocks.

Options are financial derivatives that provide the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price within a specific time frame. They are contracts rather than ownership instruments like stocks. – Investopedia

And now you are probably wondering what a Derivative is.

Derivatives are financial contracts whose value is derived from the performance of an underlying asset, such as stocks, bonds, commodities, currencies, or indices. They allow investors to speculate on price movements, hedge risks, or gain access to assets without direct ownership. Common types of derivatives include options, futures, swaps, and forwards. – CFA Institute

Still unsure?

Options are like buying a voucher to decide later. Imagine you see a car you want to buy for £10,000, but you’re not sure yet. You pay £200 to the seller for the option to buy it at that price within 30 days. If the car’s value goes up to £12,000, you can still buy it for £10,000, making a profit. If the car’s value drops to £8,000, you don’t have to buy it, but you lose the £200 you paid for the option.

In short, options give you a choice to buy or sell something at a set price, without any obligation to do so.

Derivatives are like value mirrors. They don’t have value by themselves but depend on something else. For example, a concert ticket gets its value from the concert (the “underlying asset”). If the concert is popular, the ticket price goes up. If it’s cancelled, the ticket becomes worthless.

In finance, derivatives work the same way: their value comes from assets like stocks, gold, or even currencies.

In simple terms, derivatives are contracts that “derive” their value from something else.

EODHD APIs recently added their US Stock Options Data API. This is an exciting addition to their marketplace. I thought I would “kick the tyres” on the API and see what’s there.

Please note, API data availability depends on your subscription plan. Some data isn’t included in the free plan. Visit their pricing page to find the plan that fits your needs.

Quick jump:

Understanding Options Terminology

Call: A call option gives the buyer the right, but not the obligation, to purchase the underlying stock at a specified price (strike price) on or before the expiration date. It is generally used when the buyer anticipates the stock price will rise.

Put: A put option gives the buyer the right, but not the obligation, to sell the underlying stock at a specified price (strike price) on or before the expiration date. It is typically used when the buyer expects the stock price to decline.

Strike Price: This is the predetermined price at which the buyer of a call or put option can exercise their right to buy or sell the underlying stock. It plays a crucial role in determining an option’s value relative to the market price.

Expiration Date: The expiration date is the deadline by which the option must be exercised or it becomes worthless. Options are time-sensitive, meaning their value erodes as the expiration date approaches.

Premium: The premium is the price paid by the buyer to the seller (writer) for the option contract. It reflects factors like the stock price, strike price, time to expiration, and volatility.

Implied Volatility: Implied volatility represents the market’s forecast of a likely movement in the stock price over the life of the option. Higher implied volatility indicates greater uncertainty and typically results in higher premiums.

Bid/Ask: The bid is the price a buyer is willing to pay for the option, while the ask is the price at which a seller is willing to sell. The spread between bid and ask represents the transaction cost.

In-the-Money (ITM): A call is in-the-money if the stock price is above the strike price, and a put is in-the-money if the stock price is below the strike price.

Out-of-the-Money (OTM): A call is out-of-the-money if the stock price is below the strike price, and a put is out-of-the-money if the stock price is above the strike price.

At-the-Money (ATM): An option is at-the-money when the stock price is equal to the strike price.

Let’s dive in…

We will need some code to access the API and see what is there. I’ve looked at the documentation and put this code together. I’m using a “.env” file to pass my API token through. It just needs to have one line that says “EODHD_API_TOKEN=<YOUR_TOKEN_HERE>“.

import os

import requests

import pandas as pd

from dotenv import load_dotenv

load_dotenv()

api_token = os.getenv("EODHD_API_TOKEN")

def get_options_data(market: str, from_date: str, to_date: str):

base_url = "https://eodhd.com/api/v2/options/"

market = f"{market}"

url = f"{base_url}{market}?from={from_date}&to={to_date}&api_token={api_token}"

print(url)

try:

response = requests.get(url, timeout=10)

response.raise_for_status()

json_response = response.json()

if "data" in json_response:

data = json_response["data"]

else:

return None

if "error" in data:

print(f"API Error: {data['error']}")

return None

df = pd.DataFrame(data)

return df

except requests.exceptions.Timeout:

print("Error: The request timed out. Please try again later.")

except requests.exceptions.ConnectionError:

print("Error: Could not connect to the API. Check your network connection.")

except requests.exceptions.HTTPError as http_err:

print(f"HTTP error occurred: {http_err}")

except requests.exceptions.RequestException as err:

print(f"An unexpected error occurred: {err}")

except ValueError:

print("Error: Failed to parse JSON response.")

return None

if __name__ == "__main__":

market = "AAPL.US"

from_date = "2024-01-10"

to_date = "2024-01-19"

options_df = get_options_data(market, from_date, to_date)

if not options_df.empty:

print(options_df)

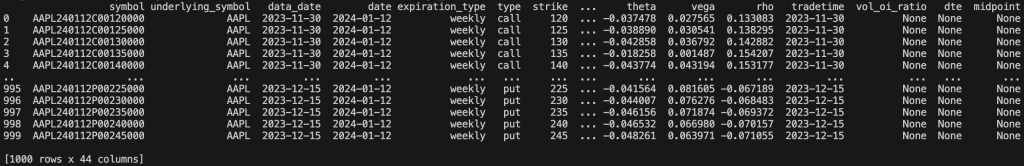

The data should look something like this…

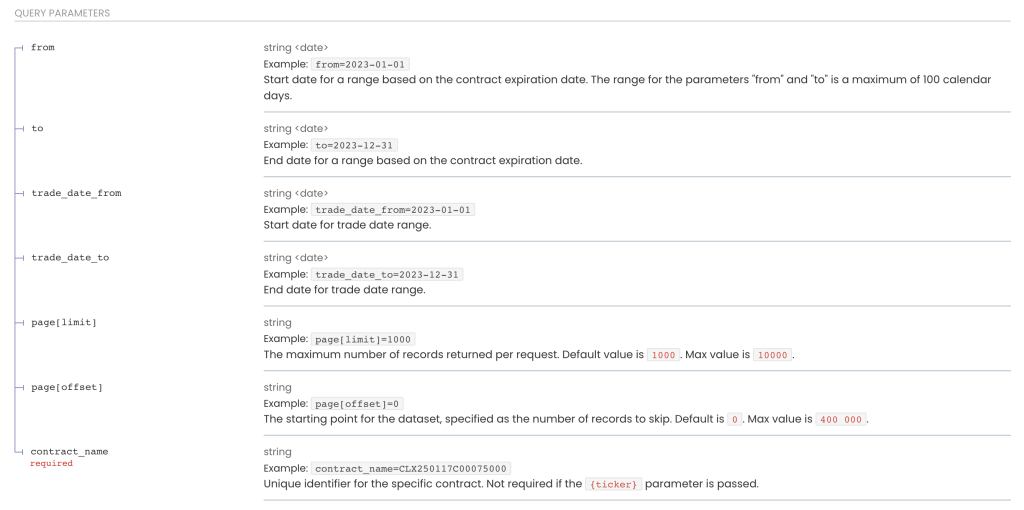

I’m going to go into detail on what all these fields mean and do in a moment. I just wanted to point out something interesting on their API endpoint. They have made it “web friendly” with the addition of page limit and offset. If you are unfamiliar with what this means, it means you can implement pagination very easily on web sites and make the navigating through the data very fast.

I’ll give you an example. Normally if you want to display a large amount of data on a web page it can be slow to retrieve and slow to render. If you tell the API you want only 100 rows with an offset of 0 you will get the first 100 rows. If you want “page 2”, you can set the offset to 100. This will give you the next 100 records starting from row 100. If you are using something like a JavaScript Bootstrap table this can really make the usability of a site a lot better. I like this new feature and I hope it’s implemented on other API endpoints as well.

Inspecting the data

The API response has 3 main fields, “meta“, “data“, and “links“.

“meta” looks like this…

"meta": {

"from": "2024-01-10",

"to": "2024-01-19",

"offset": 0,

"limit": 1000,

"total": 11450

}“data” looks like this…

{

"symbol": "AAPL240112P00245000",

"underlying_symbol": "AAPL",

"data_date": "2023-12-15",

"date": "2024-01-12",

"expiration_type": "weekly",

"type": "put",

"strike": 245,

"exchange": "NASDAQ",

"currency": "USD",

"open": null,

"high": null,

"low": null,

"last": null,

"last_size": null,

"change": null,

"pctchange": null,

"previous": null,

"previous_date": null,

"bid": 47.4,

"bid_date": "2023-12-15 14:59:59",

"bid_size": 50,

"ask": 48.25,

"ask_date": "2023-12-15 14:59:59",

"ask_size": 50,

"moneyness": null,

"volume": null,

"volume_change": null,

"volume_pctchange": null,

"open_interest": null,

"open_interest_change": null,

"open_interest_pctchange": null,

"volatility": 0.5169,

"volatility_change": null,

"volatility_pctchange": null,

"theoretical": 47.83,

"delta": -0.937793,

"gamma": 0.004625,

"theta": -0.048261,

"vega": 0.063971,

"rho": -0.071055,

"tradetime": "2023-12-15",

"vol_oi_ratio": null,

"dte": null,

"midpoint": null

}And “links” looks like this…

"links": {

"next": "https://eodhd.com/api/v2/options/AAPL.US?from=2024-01-10&to=2024-01-19&page[offset]=1000&page[limit]=1000"

}I like how “links” provides the next pagination link (excluding the API). I do have some constructive feedback to provide 🙂

I tried this URL with my API key, and it works, but not entirely.

"links": {

"next": "https://eodhd.com/api/v2/options/AAPL.US?from=2024-01-10&to=2024-01-19&page[offset]=2000&page[limit]=1000"

}I still get my “next” link which is great, but where is my “prev“? This makes it really easy and convenient to go forward, but not backwards. I think adding this would really make a big difference for web developers wanting to use this.

The “data” field is an interesting one as there are many fields there you probably have never seen before. I’ve spent some time looking them up on Investopedia and I thought I would provide a summary of what I found.

What I’ve done is group the related fields together…

These fields describe the option itself:

symbol: Unique identifier for the option (e.g., “AAPL240112P00245000”).- Format: Underlying Symbol + Expiry Date + Type (P=Put, C=Call) + Strike Price.

underlying_symbol: The stock or asset (AAPL = Apple) on which the option is based.data_date: The date this data was recorded (e.g., “2023-12-15”).date: The option’s expiry date (e.g., “2024-01-12”).expiration_type: Indicates whether the option expires weekly or monthly.type: Whether the option is a put (right to sell) or call (right to buy).strike: The strike price, or the price at which the option allows you to buy/sell the underlying asset ($245 in this case).exchange: The exchange where the option trades (e.g., “NASDAQ”).currency: Currency used for the option (e.g., “USD”).

Price and Market Data

These fields relate to option prices and trading activity:

bid: The highest price someone is willing to pay for the option ($47.4).bid_date: Date and time of the bid data (“2023-12-15 14:59:59”).bid_size: Number of contracts available at the bid price (50 contracts).ask: The lowest price at which someone is willing to sell the option ($48.25).ask_date: Date and time of the ask data.ask_size: Number of contracts available at the ask price (50 contracts).last: The most recent price at which the option traded (null here).last_size: The size (number of contracts) of the last trade.change/pctchange: Price change and percentage change from the previous day’s closing price (null here).previous: The previous closing price for the option.volume: Number of option contracts traded so far (null here).volume_change/volume_pctchange: Change in trading volume.

Open Interest (OI)

Open interest shows the number of outstanding contracts that have not been settled:

open_interest: Total number of open contracts for this option (null).open_interest_change/open_interest_pctchange: Change in open interest from the previous day.vol_oi_ratio: Ratio of trading volume to open interest, showing how active the option is relative to its outstanding contracts.

Volatility and Theoretical Value

These fields estimate the option’s potential movement and value:

volatility: Implied volatility (0.5169 here) shows how much the market expects the price of the underlying asset to move.volatility_change/volatility_pctchange: Change in implied volatility.theoretical: Theoretical (model-based) price of the option ($47.83 here).

The Greeks

The Greeks measure how sensitive the option’s price is to various factors:

delta: Measures the change in the option price for a $1 move in the underlying asset.- Put options have negative deltas; for this option,

-0.937793means the option price decreases by ~94 cents for every $1 increase in Apple’s price.

- Put options have negative deltas; for this option,

gamma: Shows how much delta changes when the underlying price moves by $1 (small value here: 0.004625).theta: Time decay – how much the option price decreases daily as it nears expiration.- A

thetaof-0.048261means the option loses about 4.8 cents daily.

- A

vega: Measures sensitivity to implied volatility changes.- Here,

0.063971means for every 1% increase in volatility, the option price rises ~6.4 cents.

- Here,

rho: Measures sensitivity to interest rate changes.- For this option,

-0.071055means a 1% increase in interest rates would reduce the price by ~7.1 cents.

- For this option,

Additional Fields

moneyness: Indicates if the option is in the money (profitable if exercised), at the money (equal to strike price), or out of the money (unprofitable).- Null here, but this would help traders understand the option’s value relative to the stock price.

dte: Days to expiration, showing how long remains before the option expires.midpoint: The average of the bid and ask prices; often used as an estimated fair price.

Summary

- General Info: Identify the option (symbol, type, expiry, strike price).

- Market Data: Understand trading prices and activity.

- Open Interest: Gauge market sentiment and liquidity.

- Volatility and Greeks: Assess risk, price movement, and sensitivity to factors like time, stock price, or volatility.

There is a lot of data here but it’s all useful. This structure helps traders make decisions like whether an option is undervalued, whether to hedge a stock position, or how quickly the option might lose value due to time decay.

Technical Analysis & Options Strategies

I read that many of the technical indicators for stock and crypto markets will also work with options (but with options-specific insights).

There are however some options specific tools which would be worth investigating like Options Chains, Greek Analysis, and Volatility Tools. These could make quite nice tutorials.

There are also some options specific strategies which may be worth looking into like Long Call, Long Put, Covered Call which are considered beginner strategies. Straddle, Strangle, Vertical Spreads, and Iron Condor which look more advanced.