In the fast-paced world of financial trading, the strategies employed by traders to navigate the complexities of the market are as diverse as they are nuanced. Among these, three strategies stand out for their pragmatic approach to executing trades while minimising market impact: the Volume Weighted Average Price (VWAP), the Time Weighted Average Price (TWAP), and the Percent of Volume (PoV) strategies. Each strategy offers a unique lens through which traders can view and engage with the market, be it through the volume-weighted lens of VWAP, the temporal focus of TWAP, or the volume percentage-based approach of PoV.

The VWAP strategy is favoured for its ability to give traders insight into the true market price of an asset, weighted by volume, therefore guiding them towards more informed trading decisions that align closely with the market. On the other hand, TWAP simplifies the trading process by averaging the price over a specified timeframe, providing a strategy that is less influenced by the volume’s fluctuations. Lastly, the PoV strategy emerges as a methodical approach for executing large orders, setting a pace that is consistent with a predetermined percentage of the market volume, thus allowing for discretion and reduced market impact.

In this article, we shall delve deeper into each of these strategies, exploring their mechanisms, applications, and the signals they offer for buying and selling. Through Python code demonstrations using OHLCV (Open, High, Low, Close, Volume) data via the EODHD APIs, we aim to illuminate the practical aspects of these strategies, providing a bridge between theoretical understanding and real-world application. Whether you’re a seasoned trader or new to the financial markets, understanding these strategies can enhance your trading toolkit, offering new avenues for navigating the complexities of market dynamics.

Quick jump:

Preparation

To illustrate the practical application of the three trading strategies—Volume Weighted Average Price (VWAP), Time Weighted Average Price (TWAP), and Percent of Volume (PoV)—we will be utilising historical OHLCV data, which we shall retrieve through EODHD APIs, employing the official EODHD API’s Python library for this purpose. Should you wish to actively participate in this tutorial and gain hands-on experience, I highly recommend securing a subscription with EODHD APIs. This will not only allow you to access the requisite data in real-time but also enhance your understanding of these strategies through direct engagement.

Start by creating yourself a new Python project and install the official EODHD API’s Python library, then create yourself a configuration file called “config.py” that looks like this.

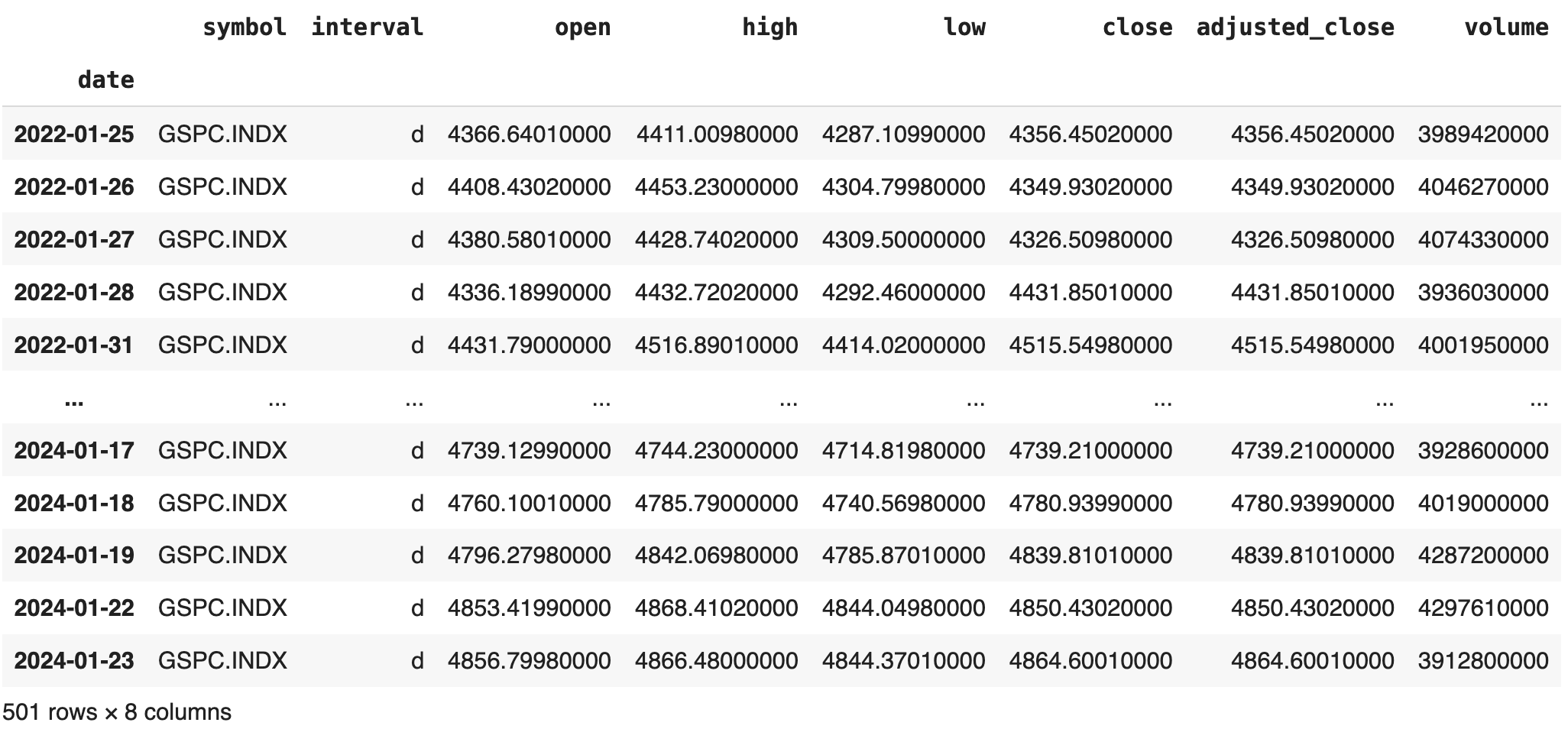

API_KEY="YOUR API KEY"Create a “main.py” that will retrieve our data. I will use the S&P 500 Index using the GSPC.INDX below.

import config as cfg

from eodhd import APIClient

api = APIClient(cfg.API_KEY)

def get_ohlc_data():

df = api.get_historical_data("GSPC.INDX", "d", results=730)

return df

if __name__ == "__main__":

df = get_ohlc_data()

print(df)

Now that we have our OLHCV (Open, Low, High, Close, Volume) data, we can look at the technical indicators…

Volume Weighted Average Price (VWAP)

Volume Weighted Average Price (VWAP) is a trading benchmark that gives an average price a security has traded at throughout the day, based on both volume and price. It is a measure of the average price at which a stock is traded over the time frame. The VWAP calculation combines the factors of price and volume to give a weighted average price. This is particularly useful for traders and investors looking to assess the market direction of a stock over the day or looking to enter or exit trades close to the average market price.

A buy signal is when the price of a stock is below the VWAP, as it is considered undervalued (similar to RSI). The rationale is that the stock is trading at a lower price compared to its average, indicating a potential upward movement to revert to the average.

Conversely, a sell signal is considered when the price is above the VWAP since the stock is deemed overvalued, suggesting a possible downward correction to align with the average price.

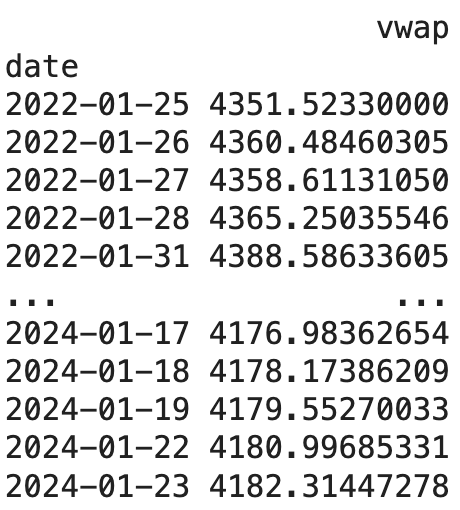

df['typical_price'] = (df['high'] + df['low'] + df['close']) / 3

df['vwap'] = (df['typical_price'] * df['volume']).cumsum() / df['volume'].cumsum()

print(df[['vwap']])

The price right now is 4,864.60. Based on the VWAP strategy criteria the S&P 500 is currently overvalued, and would indicate selling.

Time Weighted Average Price (TWAP)

The Time Weighted Average Price (TWAP) is another trading benchmark, similar to VWAP, but it focuses on time instead of volume. TWAP calculates the average price of a security over a specified time period but gives equal weight to each price point within the period, irrespective of the trading volume. This method is particularly useful when the goal is to minimise the market impact of large trades or when trading in securities with lower volume where VWAP might be less representative due to the lack of substantial volume data.

A buy signal might involve buying when the current price is below the TWAP, suggesting that the price is currently lower than the average, indicating a potential upward correction.

Conversely, selling when the current price is above the TWAP could be considered, as it suggests the price is higher than the average, indicating a potential downward correction.

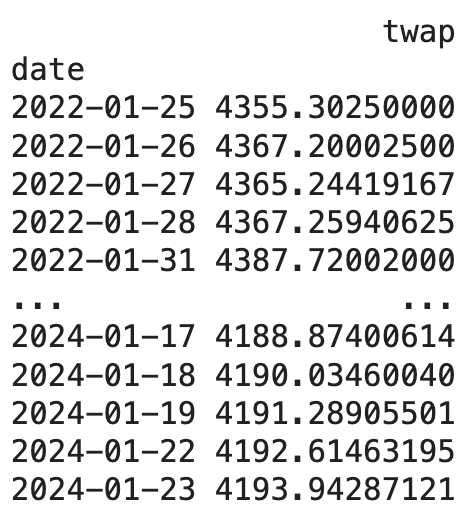

df['average_price'] = (df['open'] + df['high'] + df['low'] + df['close']) / 4

df['twap'] = df['average_price'].expanding().mean()

print(df[['twap']])

The price right now is 4,864.60. Based on the TWAP strategy criteria the S&P 500 is currently overvalued, and would indicate selling.

Percent of Volume (PoV)

Percent of Volume (PoV), often referred to in the context of trading strategies, is a strategy that aims to execute an order within a certain percentage of the market volume over a specified time period. Unlike VWAP and TWAP, which are used to calculate average prices, PoV is a trading strategy parameter that dictates the pace at which trades are executed relative to the market’s trading volume.

PoV is defined as the ratio of the trader’s order size to the total market volume over a specified time frame, usually expressed as a percentage. For example, if a trader sets a PoV strategy to 20%, it means the trader aims to limit the order’s execution to 20% of the total trading volume in each time slice, to minimise market impact.

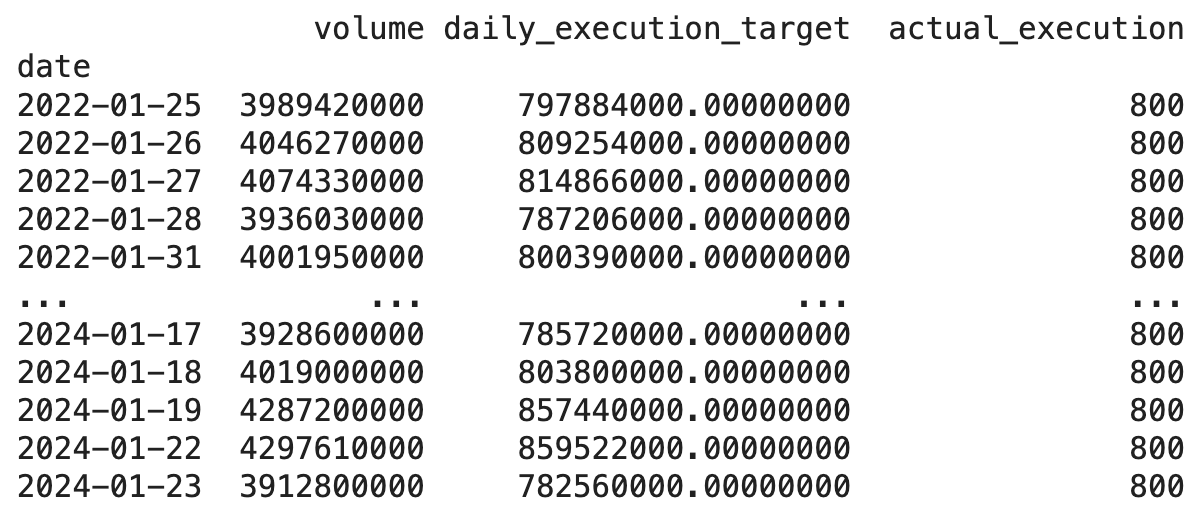

order_size = 800 # Total shares to be executed

pov_rate = 0.20 # 20% of market volume

df['daily_execution_target'] = df['volume'] * pov_rate

df['actual_execution'] = df['daily_execution_target'].apply(lambda x: min(x, order_size))

order_size -= df['actual_execution'].sum()

print(df[['volume', 'daily_execution_target', 'actual_execution']])

Conclusion

As we conclude our exploration of the Volume Weighted Average Price (VWAP), Time Weighted Average Price (TWAP), and Percent of Volume (PoV) trading strategies, it’s clear that the art of trading is as much about the method of execution as it is about the decision to buy or sell. These strategies, each with its unique approach to engaging with the market, provide traders with sophisticated tools to navigate the complexities of trading, ensuring that their moves are both strategic and informed.

The practical demonstrations using the Official EODHD API’s Python Library and OHLCV data from EODHD APIs have shown how these strategies can be applied in real-world scenarios, bridging the gap between theoretical strategies and their application. Whether aiming to minimise market impact with the PoV strategy, seeking value in the volume-weighted insights of VWAP, or leveraging the simplicity and efficiency of TWAP, traders are equipped with methodologies that can enhance decision-making and potentially improve trading outcomes.

It’s important to remember, however, that no single strategy guarantees success in the markets. The effectiveness of VWAP, TWAP, and PoV strategies, like all trading strategies, can be influenced by market conditions, liquidity, and volatility. Therefore, traders should consider these strategies as part of a broader, diversified trading approach, complementing them with other analysis and tools.

In the end, the journey through the financial markets is an ongoing learning process, where adaptability and a keen understanding of various trading strategies can pave the way for more informed and potentially successful trading decisions. As you continue to navigate the markets, let the insights from VWAP, TWAP, and PoV serve as guiding lights, illuminating your path towards achieving your trading objectives. Remember, the essence of trading lies in the balance between strategy and execution, where each decision is a step towards mastering the art of market engagement. Please do follow the EODHD Academy for more useful tips and tricks.