End-of-day data for stocks has, among others, two values that shouldn’t be confused with each other: close and adjusted close. This article will explain the difference between the two and the need to have both of these.

The close (of the OHLC, open-high-low-close) is more or less straightforward: the closing price of a stock that was registered at the end of the period. And for end of day data, it’s the trading day. It’s a raw value, and it shows just how much raw cash a stock cost at the end of the day. It does just that: tells how much a stock cost at a given date.

This value, though, cannot be used to compare all the prices of a stock to during its entire lifetime directly to each other – because, during the lifetime, there most certainly have been corporate actions that affected the price of the stock. Two primaries of those are splits and dividends. To compare stock prices during the stock’s lifetime, prices need to be adjusted to get the value of adjusted close – retroactively. This means prices get adjusted back in time from the date when an affecting event occurred.

Split Adjustments Explained

A stock split is an event of a company’s owners deciding to multiply the amount of company stock traded on the market to make each individual stock “cheaper” and more accessible. To do so, existing stock is split according to the owners’ wishes – 2 to 1, 3 to 1, 10 to 1, etc. With the company’s market capitalization intact. It means that a shareholder now has 2 (3, 10) times more stock on their hands. But the price of each is 2 (3, 10) times lower. A stock that cost $60 will now cost $30 (20, 6) – and that will be its adjusted price.

There’s also a Reverse Stock Split which is, essentially, a stock merge. E.g. 2 stocks are merged into 1, and if a stockholder had 2 shares that cost $30 each, they will instead have 1 share that costs $60.

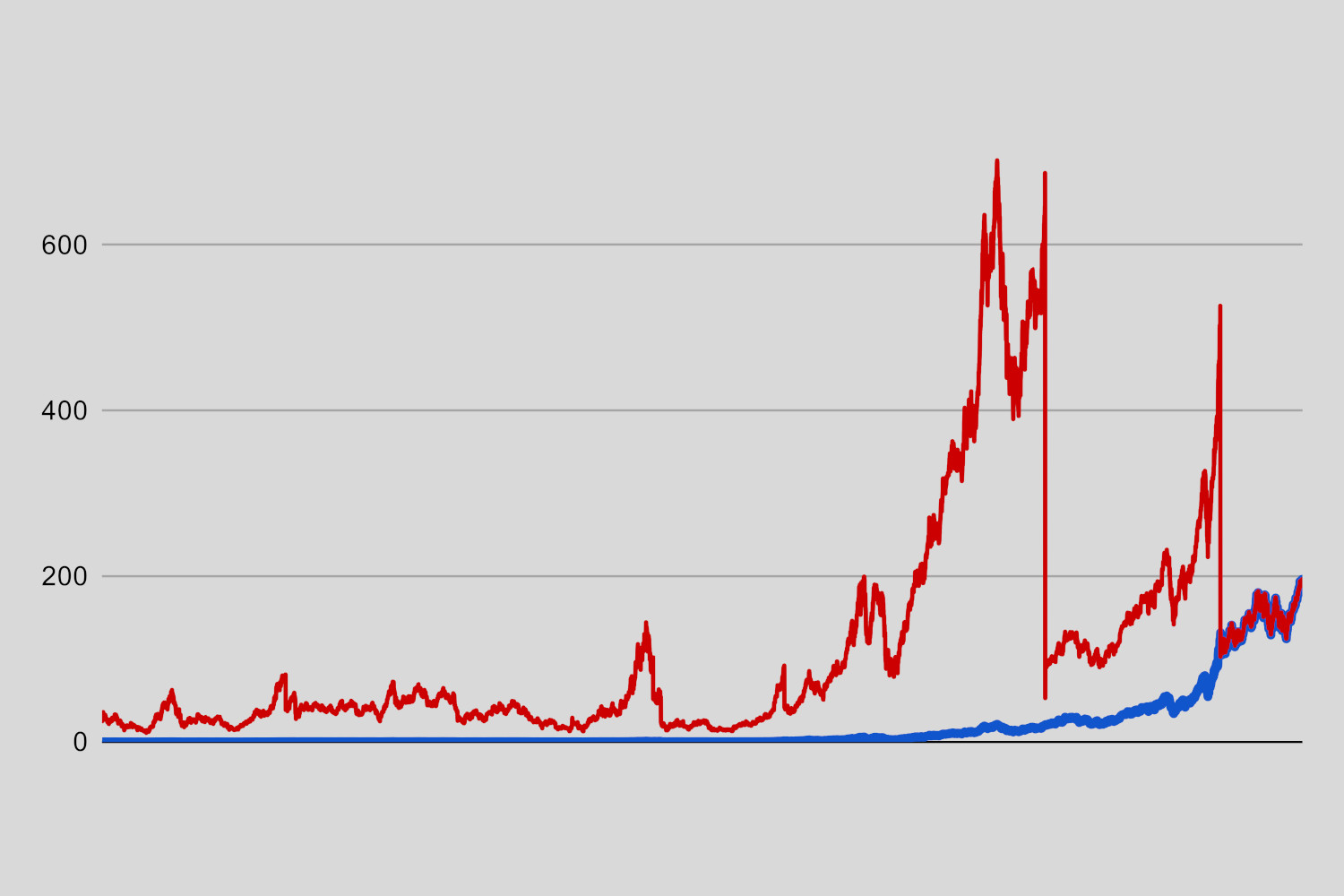

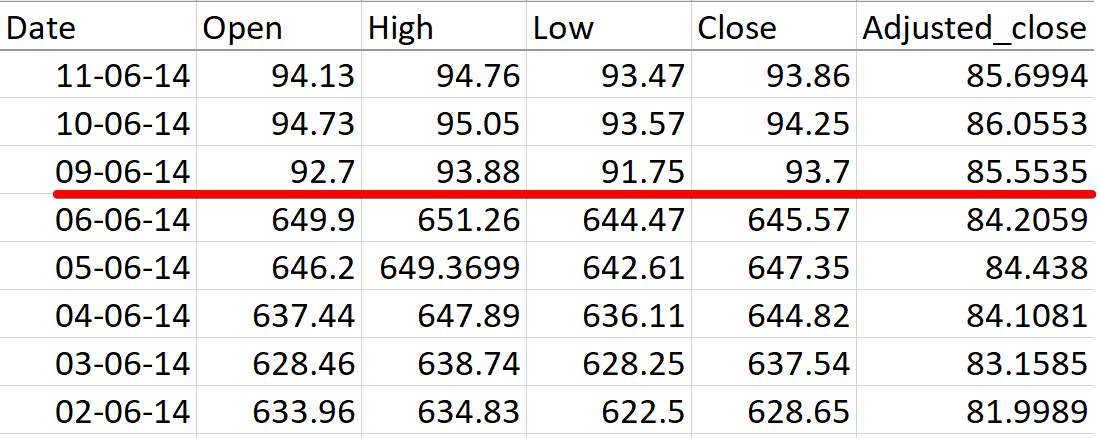

In the following example for AAPL (Apple Inc) we see that there was a split 7:1 in June 2014. The difference between OHLC data is around 7 while adjusted closes are smooth:

Dividend Adjustments Explained

Dividends – regular payments to shareholders – are considered to lower the value of each stock by the amount of a dividend, since it’s money “lost” for a company, not reinvested into the company. A dividend of $10 per stock of $60 will devalue the price of a stock by those 10 dollars. This is how the adjustment is calculated for the single day before the ex-date, but for all previous dates, the adjustment factor is calculated as the following percentage: (close price of pre-ex-date minus the dividend) divided by the close price of the pre-ex-date. In this example, that would be: (60-10) / 60 = 0.8333.

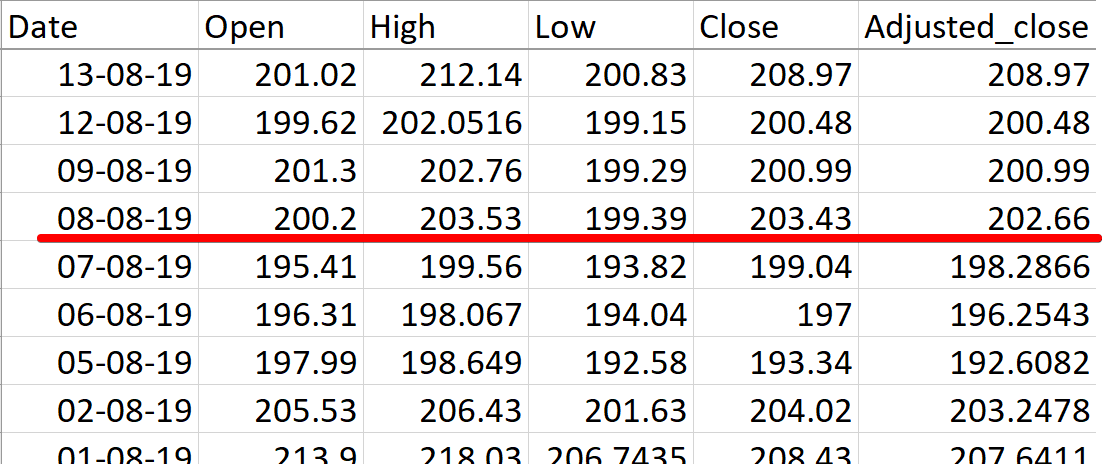

Usually closes and adjusted closes are equal to each other before the first ex-dividend date. At this point we should take the dividend payment into the account:

Eodhd.com adjusts its data to both splits and dividends, and we use the Chicago Booth adjustment algorithm (explained above) as the most proven algorithm in the industry.

Important note. When we do adjustments, we keep 4 decimal places. Some other data providers only keep 2, and it leads to discrepancies in data. Those will be small in the short history, but in the long run, the difference will be larger when comparing the company’s older data that we have to older data of other providers. Keeping 4 decimal places means our data is more precise.