Forex exchange is a decentralized global marketplace where currencies are traded. Unlike other financial markets, such as the stock market, Forex operates 24 hours a day, five days a week. However, it is essential to understand that not all hours are equally active. EODHistorical data also provides additional information on low-volume transactions outside of the main trading windows:

https://www.forex.com/en-us/help-and-support/market-trading-hours/

The Forex market is open 24 hours a day because of its decentralized nature and the fact that it involves a network of global banks, financial institutions, and individual traders. Trading hours are divided into three main sessions:

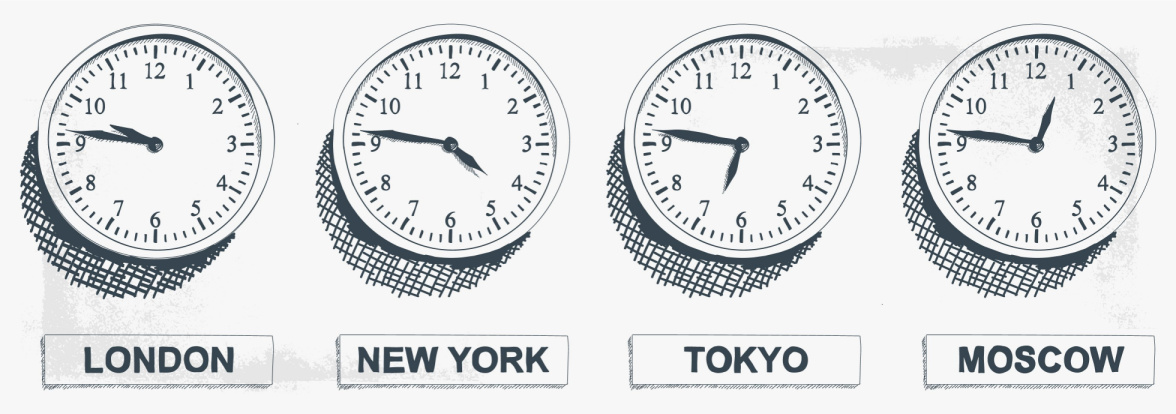

- Asian Session: This session starts at 11 PM GMT (Sunday evening) and ends at 8 AM GMT (Monday morning). It includes major financial centers such as Tokyo, Sydney, and Hong Kong.

- European Session: Active from 7 AM GMT to 4 PM GMT, the European session includes financial centers such as London, Frankfurt, and Zurich. The London session, in particular, is the most active, as it overlaps with both the Asian and North American sessions.

- North American Session: The last session of the day, the North American session, starts at 1 PM GMT and ends at 10 PM GMT. The most prominent financial centers in this session are New York and Toronto.

While the Forex market is open for 24 hours, it is important to recognize that trade volumes can vary significantly depending on the time of day and session. Generally, the highest trading volumes occur during the overlap of the European and North American sessions, specifically between 1 PM GMT and 4 PM GMT. This is because a large number of global economic announcements and news releases occur during these hours, which can cause significant market volatility.

On the other hand, trade volumes are typically low during the late Asian session and early European session, from 8 AM GMT to 11 AM GMT. During these hours, fewer economic announcements are made, and many traders are just beginning or ending their day, leading to reduced market activity.

The Forex market’s decentralized nature means that data is collected from numerous sources, including banks, financial institutions, and individual traders. This information is compiled and analyzed to provide a comprehensive picture of the market. Sources such as the Electronic Broking Services (EBS) and Thomson Reuters Dealing systems collect trade data from major banks and financial institutions. Additionally, trading platforms and brokerage firms can also provide insight into market activity by analyzing the trades executed on their platforms.

Understanding the working hours of the Forex exchange is crucial for traders who want to capitalize on market opportunities. By staying informed about market fluctuations and the sources from which data is