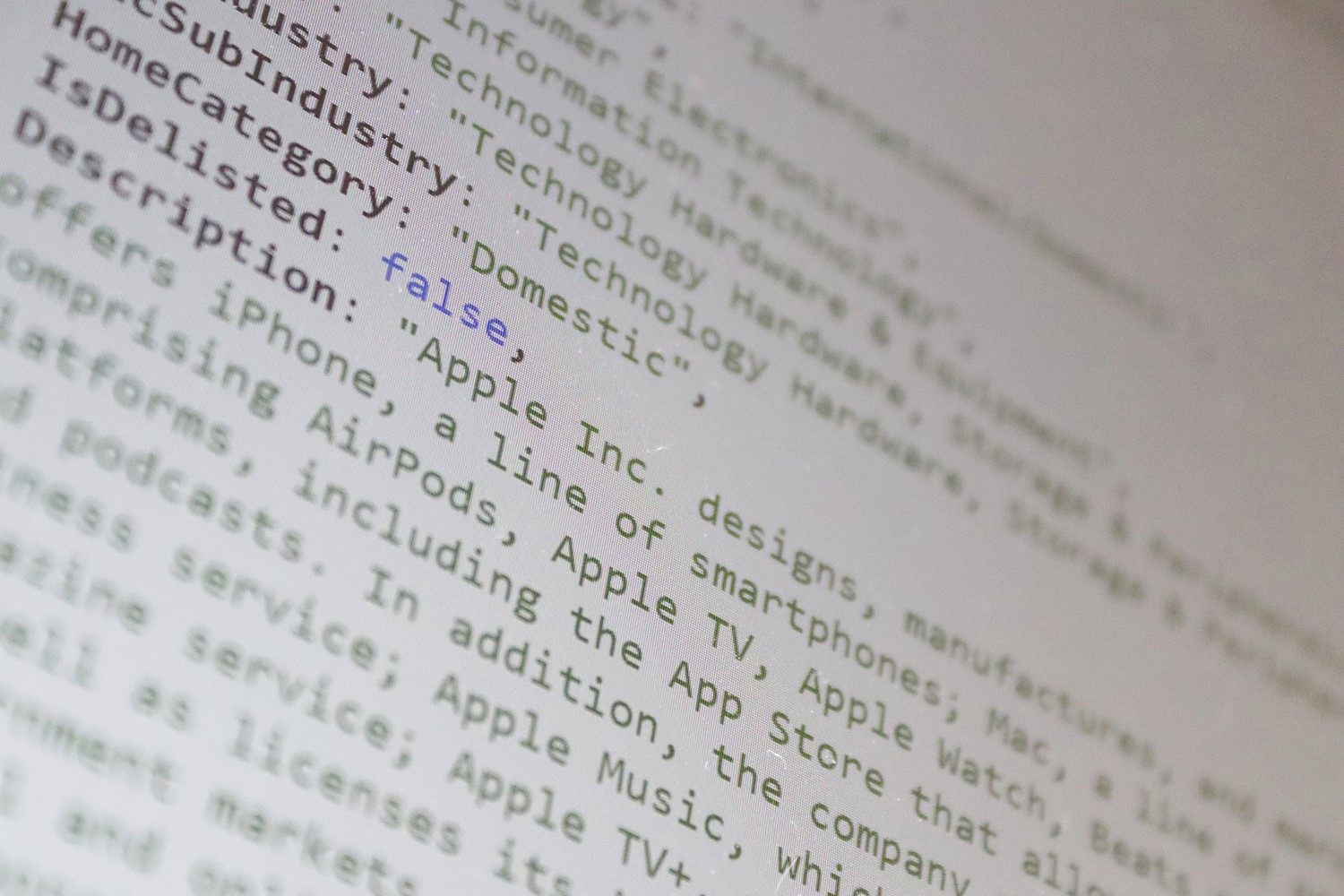

We’re glad to introduce the first glossary of data fields of our Fundamental Data API. This glossary provides a comprehensive list of the data elements that are integral to the output of this API when querying stock tickers.

The fundamentals template is standardized across all exchanges, with the notable exceptions being the isDelisted field and the AnalystRatings section missing from non-US stocks.

Quick jump:

General

Code: the ticker code.

Type: equity type (Common Stock or Preferred Stock).

Name: self-explanatory.

Exchange: the EODhistoricaldata.com code of the stock exchange of this specific ticker (this is NOT to be interpreted as “primary exchange”).

CurrencyCode: the alpha-3 (three-letter ISO 4217) trading currency code of the stock.

CurrencyName: the more conventional name of the currency.

CurrencySymbol: the conventional currency symbol. $ for USD, £ for British Pound, etc.

CountryName: the name of the country in which the stock exchange is located.

CountryISO: the ISO code of the country.

OpenFigi: the Open FIGI code.

ISIN: International Securities Identification Number, a non-unique stock identifier (can be shared between ticker codes for stocks of the same company traded on different exchanges).

LEI: Legal entity identifier code. A unique identification code for entities which trade in financial markets (stocks, bonds, futures, forex, etc).

PrimaryTicker: the ticker that is considered primary to this company. E. g.: the ticker AAPL.US would be primary for the ticker APC.XETRA.

CUSIP: CUSIP number (for US and Canadian stocks).

CIK: Central Index Key, another identifier for US and Canadian stocks.

FiscalYearEnd: self-explanatory.

EmployerIdNumber: the unique identifier that is assigned to a business entity so that it can easily be identified by the Internal Revenue Service (IRS).

IPODate: self-explanatory.

InternationalDomestic: the relation of the company to the US market.

Sector: segment of economy the company is related to.

Industry: a more specific group of companies and businesses that the company is related to.

GicSector: Global Industry Classification Standard / GICS.

GicGroup: Global Industry Classification Standard / GICS.

GicIndustry: Global Industry Classification Standard / GICS.

GicSubIndustry: Global Industry Classification Standard / GICS.GICS.

HomeCategory: ADR, ADR Primary, ADR Secondary, ADR Preferred, ADR Warrant, Canadian, Canadian Primary, Canadian Preferred, Canadian Warrant, CEF, Domestic, Domestic Primary, Domestic Secondary, Domestic Preferred, Domestic Warrant, ETD, ETN, Warrant – a range of categories for US stock tickers.

IsDelisted: true (for delisted tickers) or false (for active tickers). Only visible for US stocks.

DelistedDate: self-explanatory (last date of trading data available). Only visible for US stocks marked as delisted.

Description: self-explanatory.

Address: self-explanatory.

AddressData: the address line separated into fields. The sub-fields are self-explanatory.

Listings: the various listings of the same company on other stock exchanges around the world. The sub-fields are self-explanatory.

Officers: the list of the company’s officers. The sub-fields are self-explanatory.

Phone: self-explanatory.

WebURL: self-explanatory.

LogoURL: the URL to obtain the logo of the company. The URL in this field must be added to the domain eodhistoricaldata.com.

FullTimeEmployees: the current latest known amount of the company’s full time employees.

UpdatedAt: the field showing the last date when the fundamentals file for this ticker was updated (manually or automatically). The Highlights, SharesStats and Valuation sections of active tickers can refer to this date as the date they were last updated.

Highlights

MarketCapitalization: the total value of all shares of a company’s stock. It is calculated by multiplying the price of a stock by its total number of outstanding shares. We have an article on calculating it historically.

MarketCapitalizationMln: self-explanatory.

EBITDA: earnings before interest, taxes, depreciation, amortization (TTM).

PERatio: price to earnings ratio (TTM).

PEGRatio: price to earnings growth ratio, 5 year expected.

WallStreetTargetPrice: end of year price target for the security from a pool of top security analysts. For non-US stocks traded non-US exchanges, the currency of this field relates to the currency of the country the company originates from (e. g. for KAP.IL, this field is in KZT despite the ticker traded in USD on LSE).

BookValue: book value per share (total assets minus total liabilities, divided by shares outstanding) (MRQ).

DividendShare: the sum of all dividends over the last year (TTM).

DividendYield: annual dividend yield (DividendShare divided by current price) (TTM).

EarningsShare: diluted earnings per share (TTM).

EPSEstimateCurrentYear: estimated earnings per share for the current year.

EPSEstimateNextYear: estimated earnings per share for the next year.

EPSEstimateNextQuarter: estimated earnings per share for the next quarter.

EPSEstimateCurrentQuarter: estimated earnings per share for the current quarter.

MostRecentQuarter: the most recent quarter that has financial data.

ProfitMargin: the net profit margin.

OperatingMarginTTM: (operatingIncome / totalRevenue) * 100 (TTM).

ReturnOnAssetsTTM: netincome / totalAssets (TTM).

ReturnOnEquityTTM: netIncome / totalStockholderEquity (TTM).

RevenueTTM: the amount of revenue the company has generated (TTM).

RevenuePerShareTTM: totalRevenue / commonStockSharesOutstanding (TTM).

QuarterlyRevenueGrowthYOY: year-over-year comparison means the revenue for e. g. Q4 of Year 2 is compared to the revenue for Q4 of Year 1.

GrossProfitTTM: totalRevenue (TTM) – costOfRevenue (TTM).

DilutedEpsTTM: diluted earnings per share (TTM).

QuarterlyEarningsGrowthYOY: year-over-year comparison means the earnings for e. g. Q4 of Year 2 is compared to the earnings for Q4 of Year 1.

Valuation

TrailingPE: the price-to-earnings ratio (TTM).

ForwardPE: the price-to-earnings ratio that uses estimated earnings per share for calculation.

PriceSalesTTM: the price-to-sales ratio (TTM).

PriceBookMRQ: the price-to-book ratio (MRQ).

EnterpriseValue: MarketCapitalization + shortLongTermDebtTotal + minorityInterest – cashAndEquivalents. The currency of this field is the same as of the company’s financial reports.

EnterpriseValueRevenue: the enterprise value-to-revenue ratio.

EnterpriseValueEbitda: the enterprise value to EBITDA ratio.

SharesOutstanding: the current number of outstanding shares issued and actively held by the stockholders. If a company has several share classes, this field shows shares pertaining to the ticker-specific class of shares, while the other shares outstanding locations of the file (such as outstandingShares) show all classes’ shares outstanding of the company.

SharesFloat: the number of shares a company actually has available to trade in the open market.

PercentInsiders: insider ownership percentage.

PercentInstitutions: institutional investor ownership percentage.

SharesShort

SharesShortPriorMonth

ShortRatio

ShortPercentOutstanding

ShortPercentFloat

Technicals

Beta: the 5-year levered beta based on main indices for the country.

52WeekHigh: the highest price of the trailing year (of the “High” field of raw OHLC), adjusted to the day’s adjustment factor.

52WeekLow: the lowest price of the trailing year (of the “Low” field of raw OHLC), adjusted to the day’s adjustment factor.

50DayMA: the 50-day simple moving average (SMA).

200DayMA: the 200-day simple moving average (SMA).

SharesShort: the number of shorted shares.

SharesShortPriorMonth: the number of shorted shares in the previous month.

ShortRatio: the number of shares of a security that investors have sold short divided by the average daily volume of the security (measured over 30 days).

ShortPercent: the number of shorted shares divided by the number of shares outstanding. To see this as a percent figure, it has to be multiplied by 100 (0.00150 is 0.15%).

SplitsDividends

ForwardAnnualDividendRate: the expected future dividend rate (yearly dividend payout in currency); price * ForwardAnnualDividendYield.

ForwardAnnualDividendYield: the expected future dividend yield (dividends / price).

PayoutRatio: the percentage of net income that a company pays out as dividends to common shareholders (TTM): the sum of the latest 4 quarters’ dividendsPaid divided by the sum of the latest 4 quarters’ netIncomeApplicableToCommonShares, or just netIncome if the former field is not available.

DividendDate: the latest dividend payout date.

ExDividendDate: the latest ex-dividend date.

LastSplitFactor: the latest split factor.

LastSplitDate: the latest split date.

NumberDividendsByYear: the number of times dividends were paid out each year. The sub-fields are self-explanatory.

AnalystRatings

Rating: a score of 1 to 5, where 1 is Strong Sell and 5 is Strong Buy.

TargetPrice: the average target price of the security a year ahead from today.

StrongBuy: the number of analysts assessing the security as a Strong Buy.

Buy: the number of analysts assessing the security as a Buy.

Hold: the number of analysts assessing the security as a Hold.

Sell: number of analysts assessing the security as a Sell.

StrongSell: number of analysts assessing the security as a Strong Sell.

Holders

Institutions or Funds: holder type, self-explanatory.

name: the name of the institution or fund.

date: self-explanatory.

totalShares: the percentage of a ticker’s shares that an institution holds.

totalAssets: the percentage that these shares make up in the assets held by the institution.

currentShares: self-explanatory,

change: the change to currentShares as compared to the previous position (in the previous quarter).

change_p: the percentage of the change to currentShares as compared to the previous position.

InsiderTransactions

date: self-explanatory.

ownerCik: the CIK code of the owner, if applicable.

ownerName: self-explanatory.

transactionDate: same as date.

transactionCode: S for sale, P for purchase.

transactionAmount: the amount of shares that were part of the transaction.

transactionPrice: the price per share at which the transaction was completed.

transactionAcquiredDisposed: A for acquired, D for disposed.

postTransactionAmount: how many shares the person holds after the transaction.

secLink: self-explanatory.

ESGScores

Disclaimer: self-explanatory.

RatingDate: self-explanatory.

TotalEsg:

TotalEsgPercentile:

EnvironmentScore:

EnvironmentScorePercentile:,

SocialScore:

SocialScorePercentile:

GovernanceScore:

GovernanceScorePercentile:

ControversyLevel:

ActivitiesInvolvement: self-explanatory.

Activity: the various activities, which are the following: “adult”, “alcoholic”, “animalTesting”, “catholic”, “controversialWeapons”, “smallArms”, “furLeather”, “gambling”, “gmo”, “militaryContract”, “nuclear”, “pesticides”, “palmOil”, “coal”, “tobacco”.

Involvement: Yes or No.

annual or quarterly: self-explanatory.

date: the specific year or the specific quarter.

dateFormatted: denotes the end of the period.

sharesMln: weighted average diluted shares outstanding in millions (adjusted to stock splits).

shares: weighted average diluted shares outstanding (adjusted to stock splits).

Earnings

History

the historical section of the quarterly earnings data.

reportDate: the date of the actual report. It should be noted that for US stocks specifically, this is the date of the 8K report, not of the 10K/10Q one (for those reports’ dates, please see the Financials section). For major companies, such as e. g. AAPL, this might be just the day before the earnings call, while for lesser companies, such as e. g. SCCO, the difference in days between the two reports may be longer.

date: the end of the reported period.

beforeAfterMarket: BeforeMarket: earnings reported before market opened; AfterMarket: earnings reported after market closed; null: unknown.

epsActual: the actual non-GAAP EPS reported by the company.

epsEstimate: the EPS that was estimated to happen prior to the earnings release,

epsDifference: epsActual – epsEstimate.

surprisePercent: (epsActual – epsEstimate) / epsEstimate.

Trend

the section containing historical predictions of the earnings.

YYYY-MM-DD: the period’s end date, self-explanatory.

period: the period for which the prediction is made. +1y means next year, 0y means current year, +1q means next quarter, 0q means current quarter,

growth: estimated expected growth of the EPS, same as earningsEstimateGrowth. The formula is: (earningsEstimateAvg – earningsEstimateYearAgoEps) / earningsEstimateYearAgoEps.

earningsEstimateAvg: the average EPS estimate from Wall Street analysts.

earningsEstimateLow: the lowest EPS estimate from Wall Street analysts.

earningsEstimateHigh: the highest EPS estimate from Wall Street analysts.

earningsEstimateYearAgoEps: the epsEstimate as it was a year ago (not adjusted).

earningsEstimateNumberOfAnalysts: the number of analysts that provided the earnings estimate for the ticker.

earningsEstimateGrowth: estimated expected growth of the EPS, same as growth. The formula is: (earningsEstimateAvg – earningsEstimateYearAgoEps) / earningsEstimateYearAgoEps.

revenueEstimateAvg: the average expected revenue estimate from Wall Street analysts.

revenueEstimateLow: the lowest expected revenue estimate from Wall Street analysts.

revenueEstimateHigh: the highest expected revenue estimate from Wall Street analysts.

revenueEstimateYearAgoEps: the revenue estimate as it was a year ago.

revenueEstimateNumberOfAnalysts: the number of analysts that provided the revenue estimate for the ticker.

revenueEstimateGrowth: estimated expected growth of the revenue.

epsTrendCurrent: the current EPS estimate.

epsTrend7daysAgo: the EPS estimate as it was a week ago.

epsTrend30daysAgo: the EPS estimate as it was a month ago.

epsTrend60daysAgo: the EPS estimate as it was two months ago.

epsTrend90daysAgo: the EPS estimate as it was three months ago.

epsRevisionsUpLast7days: the number of “up” EPS estimate revisions during the week prior to the current estimate.

epsRevisionsUpLast30days: the number of “up” EPS estimate revisions during the month prior to the current estimate.

epsRevisionsDownLast7days: the number of “down” EPS estimate revisions during the week prior to the current estimate.

epsRevisionsDownLast30days: the number of “down” EPS estimate revisions during the month prior to the current estimate.

Annual

the annual section of the earnings history. Please note that for the current fiscal year, the annual figure is the sum of earnings currently available, and therefore the date for the year also denotes the latest quarter available.

date: self-explanatory.

epsActual: the sum of the 4 quarterly EPS of the calendar year.

Financials

Balance_Sheet

currency_symbol: self-explanatory.

quarterly or yearly: self-explanatory.

date: self-explanatory.

filing_date: the filing date of the financial report.

totalAssets: the total amount of assets owned by a company.

intangibleAssets: assets that have no physical form. These are long-term assets that accrue value year over year. Examples of intangible assets include intellectual property, brand recognition and reputation, relationships, and goodwill.

earningAssets: income-producing investments that are owned or held by a business, institution, or individual. Earning assets include stocks, bonds, rental property income, CDs, and other interest or dividend-earning accounts.

otherCurrentAssets: a category of things of value that a company owns, benefits from, or uses to generate income that can be converted into cash within one business cycle.

totalLiab: the combined debts and obligations that a company owes to outside parties. totalLiab = totalCurrentLiabilities + nonCurrentLiabilitiesTotal.

totalStockholderEquity: assets remaining in a business once all liabilities have been settled. totalStockholderEquity = totalAssets – totalLiab.

deferredLongTermLiab: deferred tax liability is a type of long-term liability incurred when a company postpones paying taxes on certain types of accounting income. The amount of the liability is the difference between a company’s taxable income and its accounting or book income.

otherCurrentLiab: the current liabilities (due within 12 months) that are insignificant separately, but are clumped together on the company’s liabilities.

commonStock: same as capitalStock.

capitalStock: the total amount of common and preferred shares that a company is authorized to issue, according to its corporate charter. Capital stock can only be issued by the company and is the maximum number of shares that can ever be outstanding.

retainedEarnings: same as retainedEarningsTotalEquity. The amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders.

otherLiab: all balance sheet liability accounts not covered specifically in other areas of the supervisory activity.

goodWill: an intangible asset that is associated with the purchase of one company by another. It represents value that can give the acquiring company a competitive advantage. The value of a company’s name, brand reputation, loyal customer base, solid customer service, good employee relations, and proprietary technology represent aspects of goodwill. This value is why one company may pay a premium for another.

otherAssets: same as nonCurrrentAssetsOther.

cash: the fields cash and cashAndEquivalents are interchangeable for US tickers, the latter being a later addition to the template. For other exchanges, this may differ in some cases, and “cash” will only have the cash figure.

cashAndEquivalents: the fields cash and cashAndEquivalents are interchangeable for US tickers, the latter being a later addition to the template. For other exchanges, this may differ in some cases, and “cashAndEquivalents” will have the figure corresponding to cash and its equivalents from the financial report.

totalCurrentLiabilities: the current liabilities (due within 12 months). accountsPayable + shortLongTermDebt + otherCurrentLiab + (Current portion of operating lease liabilities – not yet available) + (Income taxes payable – not available). OR: shortTermDebt + shortLongTermDebtTotal + otherCurrentLiab. OR: totalCurrentLiabilities = totalLiab – nonCurrentLiabilitiesTotal.

currentDeferredRevenue: the deferred revenue liability, current to the period. It can be used in place of deferred liability.

netDebt: a metric that shows how much debt a company has on its balance sheet compared to its liquid assets. netDebt = shortTermDebt + longTermDebtTotal – cash.

shortTermDebt: Short-term debt refers to any debt that is due within one year or less. This may include loans, credit card balances, and other obligations that are expected to be paid off within the next 12 months. For some companies, this number represents the current capital lease obligations.

shortLongTermDebt: the Short/Current Long-Term Debt (current portion of the long term debt).

shortLongTermDebtTotal: may differ between companies: longTermDebt/longTermDebtTotal + shortTermDebt / + shortLongTermDebt / = shortLongTermDebtTotal.

otherStockholderEquity: may correspond to accumulatedOtherComprehensiveIncome with some companies, or may differ for others.

propertyPlantEquipment: same as propertyPlantAndEquipmentNet.

totalCurrentAssets: the sum of all current assets. totalCurrentAssets = cashAndEquivalents + shortTermInvestments + netReceivables +inventory + otherCurrentAssets.

longTermInvestments: marketable securities.

netTangibleAssets: the total physical assets of a company minus all intangible assets and liabilities.

shortTermInvestments: marketable securities.

netReceivables: the total money owed to a company by its customers minus the money owed that will likely never be paid.

longTermDebt: any debt that is due in more than one year.

inventory: raw materials used to produce goods as well as the goods that are available for sale.

accountsPayable: amounts due to vendors or suppliers for goods or services received that have not yet been paid for.

totalPermanentEquity: the sum of paid in capital and net income less any distributions.

noncontrollingInterestInConsolidatedEntity: minority interest in the balance sheet.

temporaryEquityRedeemableNoncontrollingInterests: an ownership stake in a corporation, with the investors owning a minority interest and having less influence over how the company is managed.

accumulatedOtherComprehensiveIncome: same as otherStockholderEquity.

additionalPaidInCapital: the difference between the par value of a stock and the price that investors actually pay for it.

commonStockTotalEquity: the total amount of all investments in a company made by common equity investors, including the total value of all shares of common stock, plus retained earnings and additional paid-in capital.

preferredStockTotalEquity: the total amount of all investments in a company made by preferred equity investors.

retainedEarningsTotalEquity: same as retainedEarnings.

treasuryStock: the portion of a company’s shares that are held by its treasury and not available to the public.

accumulatedAmortization: the cumulative amount of all amortization expenses that has been charged against an intangible asset.

nonCurrrentAssetsOther: same as otherAssets. noncurrent assets are long-term and have a useful life of more than a year.

deferredLongTermAssetCharges: long-term prepaid expenses that are carried as an asset on a balance sheet until used/consumed.

nonCurrentAssetsTotal: noncurrent assets are long-term and have a useful life of more than a year.

capitalLeaseObligations: long-term (non-current) amount of hire charges or rent owed by the lessee to the lessor for taking capital assets on hire under a capital lease.

longTermDebtTotal: may be same as longTermDebt for some companies, or longTermDebt + capitalLeaseObligations for others.

nonCurrentLiabilitiesOther: a part of non-current liabilities that is not directly classifiable.

nonCurrentLiabilitiesTotal: the debts that a business owes, but isn’t due to pay for at least 12 months. nonCurrentLiabilitiesTotal = totalLiab – totalCurrentLiabilities.

negativeGoodwill: negative goodwill, also known as bargain purchase gain, occurs when the fair value of the net assets acquired in a merger or acquisition exceeds the purchase price.

warrants: the amount of derivatives that give the right, but not the obligation, to buy or sell a security – most commonly an equity – at a certain price before expiration.

preferredStockRedeemable: a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock to treasury stock.

capitalSurpluse: the surplus resulting after common stock is sold for more than its par value.

liabilitiesAndStockholdersEquity: same as totalAssets: liabilitiesAndStockholdersEquity = totalLiab + totalStockholderEquity.

cashAndShortTermInvestments: cash and short term investments.

propertyPlantAndEquipmentGross: gross PPE,

propertyPlantAndEquipmentNet: net PPE, same as propertyPlantEquipment.

accumulatedDepreciation: the total amount an asset has been depreciated up until a single point.

netWorkingCapital: (totalCurrentAssets – cash) – (totalCurrentLiabilities – shortLongTermDebtTotal).

netInvestedCapital: the total amount of money that a company spends on capital assets, minus the cost of the depreciation of those assets.

commonStockSharesOutstanding: the shares of common stock that have been issued minus any shares of common stock known as treasury stock. This is the weighted average diluted number (the total number of shares if the convertible securities of a company were exercised) used for EPS calculations.

Income_Statement

quarterly or yearly: self-explanatory.

date: the date of the end of the corresponding period.

filing_date: the date the report was filed.

currency_symbol: self-explanatory, the currency of the figures of the report.

researchDevelopment: R&D expenses.

effectOfAccountingCharges: charges that include items such as depreciation, amortization, bad debt, and other expenses that are associated with the normal operations of a business.

incomeBeforeTax: self-explanatory. incomeBeforeTax = operatingIncome – nonOperatingIncomeNetOther.

minorityInterest: a minority interest refers to a stake in a company that is otherwise controlled by a parent company. On the income statement, minority interest is recorded as a share of the minority shareholders’ profit.

netIncome: self-explanatory. netIncome = incomeBeforeTax – incomeTaxExpense – minorityInterest OR netIncome = operatingIncome – interestExpense – incomeTaxExpense OR netIncome = operatingIncome – incomeTaxExpense, depending on how it was reported.

sellingGeneralAdministrative: selling, general, and administrative expenses (SG&A) – all general and administrative expenses (G&A) as well as the direct and indirect selling expenses of a business.

sellingAndMarketingExpenses: may be a component of sellingGeneralAdministrative, not reported in that case; or a field of its own, reported separately.

grossProfit: self-explanatory: the gross profit. grossProfit = totalRevenue – costOfRevenue.

reconciledDepreciation: same as depreciationAndAmortization for US tickers.

ebit: ebit = totalRevenue – costOfRevenue – totalOperatingExpenses. In most cases this should be the same as operatingIncome, if the companies report it as such. In other cases, it may be operatingIncome + netInterestIncome + totalOtherIncomeExpenseNet.

ebitda: earnings before interest, taxes, depreciation, amortization; ebit + depreciationAndAmortization.

depreciationAndAmortization: depreciation and amortization, same as reconciledDepreciation for US tickers.

nonOperatingIncomeNetOther: income (loss) not attributable to operating income.

operatingIncome: self-explanatory. operatingIncome = totalRevenue – totalOperatingExpenses OR operatingIncome = totalRevenue – totalOperatingExpenses – costOfRevenue, depending on how it was reported. In most cases this should be the same as ebit.

otherOperatingExpenses: the total expenses / cost and expenses field.

interestExpense: the cost incurred by an entity for borrowed funds.

taxProvision: the reporting period’s total income tax expense.

interestIncome: income incurred from interest-related operations, a banking sphere field.

netInterestIncome: net interest income incurred from interest-related operations, a banking sphere field.

extraordinaryItems: obsolete: International Financial Reporting Standards (IFRS) does not recognize the concept of an extraordinary item, which has led to the practice of classifying extraordinary items as separate from nonrecurring items to become obsolete.

nonRecurring: income received which is not anticipated to continue in future months.

otherItems: other possible income.

incomeTaxExpense: the expenses incurred by tax paying.

totalRevenue: self-explanatory, a reported figure. totalRevenue = operatingIncome + totalOperatingExpenses. For banks, totalRevenue can be calculated as interestIncome + totalOtherIncomeExpenseNet.

totalOperatingExpenses: companies apply their own logic to calculating expenses. It may be: researchDevelopment + sellingGeneralAdministrative + sellingAndMarketingExpenses + depreciationAndAmortization (some tickers include D&A, some do not); it may be different. Check the companies’ original report to see how exactly they calculate their expenses.

costOfRevenue: otherwise known as “cost of goods sold”, a reported figure. costOfRevenue = totalOperatingExpenses – sellingGeneralAdministrative.

totalOtherIncomeExpenseNet: nonOperatingIncomeNetOther + netInterestIncome.

discontinuedOperations: net income (loss) from discontinued operations, not a subcomponent of extraordinaryItems or nonRecurring.

netIncomeFromContinuingOps: self-explanatory.

netIncomeApplicableToCommonShares: the portion of net income that should be used in calculations where only the common shares are applicable, if a company has more than one class of shares.

preferredStockAndOtherAdjustments: the aggregate value of preferred stock dividends and other adjustments necessary to derive net income apportioned to common stockholders.

Cash_Flow

quarterly or yearly: self-explanatory.

date: the date of the end of the corresponding period.

filing_date: the date the report was filed.

currency_symbol: self-explanatory, the currency of the figures of the report.

investments: self-explanatory.

changeToLiabilities: the increase or decrease in liabilities from one period to the next.

totalCashflowsFromInvestingActivities: self-explanatory.

netBorrowings: total debt borrowed during the year minus total debt repaid in the year.

totalCashFromFinancingActivities: self-explanatory.

changeToOperatingActivities: a change (positive or negative) to operating activities, not to be confused with totalCashFromOperatingActivities.

netIncome: see the same field on the income statement.

changeInCash: changeInCash = endPeriodCashFlow – beginPeriodCashFlow. Same as cashAndCashEquivalentsChanges for tickers where cash = cashAndEquivalents.

beginPeriodCashFlow: how much cash was available at the start of the period.

endPeriodCashFlow: how much cash was available at the end of the period.

totalCashFromOperatingActivities: cash from operations, not to be confused with changeToOperatingActivities.

issuanceOfCapitalStock: the amount of income from the process through which a company offers and sells its shares of stock to investors in order to raise capital.

depreciation: depreciation and amortization, same as reconciledDepreciation and depreciationAndAmortization from the income statement.

otherCashflowsFromInvestingActivities: a non-classified part of investing activities cash flow.

dividendsPaid: the sum of all cash dividends paid during the period.

changeToInventory: the difference between additions to and withdrawals from inventories.

changeToAccountReceivables: increase or decrease in the account receivables during the period.

salePurchaseOfStock: cash flow generated from the sale of securities, such as stocks and bonds (positive), or repurchases of common stock (negative).

otherCashflowsFromFinancingActivities: a non-classified part of financing activities cash flow.

changeToNetincome: increase or decrease of the net income during the period.

capitalExpenditures: funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment.

changeReceivables: increase or decrease in the cash that customers owe the company.

cashFlowsOtherOperating: a non-classified part of operating activities cash flow.

exchangeRateChanges: changes in the value of a company’s cash balance due to fluctuations in foreign currency exchange rates.

cashAndCashEquivalentsChanges: the change in the cashAndCashEquivalents field during the period. Same as changeInCash for tickers where cash = cashAndEquivalents.

changeInWorkingCapital: The excess of current assets over current liabilities is referred to as the company’s working capital; the difference between the working capital for two given reporting periods is called the change in working capital. changeInWorkingCapital = changeToAccountReceivables + changeToInventory + changeToLiabilities + changeToOperatingActivities.

stockBasedCompensation: a kind of compensation given by companies to their employees in the form of equity shares besides the regular cash or salary and bonuses they receive.

otherNonCashItems: expenses listed on an income statement, such as capital depreciation, investment gains, or losses, that do not involve a cash payment. Examples of non-cash items include depreciation, amortization, deferred income tax, stock based compensation that is provided to employees.

freeCashFlow: the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). totalCashFromOperatingActivities – capitalExpenditures = freeCashFlow.