Introduction

Welcome to the comprehensive guide to understanding dividends and how they can contribute to passive income. In this article, we will explore what dividends are, how they work, and the benefits they offer to investors seeking a steady stream of income from their investments.

Understanding Dividends

Dividends are a distribution of a portion of a company’s earnings to its shareholders. When a company generates profits, it can choose to reinvest those profits back into the business or distribute them to shareholders in the form of dividends. Dividends are typically paid out regularly, such as quarterly or annually, and are based on the number of shares an investor owns.

How Do Dividends Work?

Dividends are typically paid in cash, although some companies may offer dividend reinvestment programs where shareholders can receive additional shares instead of cash. The amount of the dividend is determined by the company’s board of directors and is usually expressed as a fixed amount per share or as a percentage of the share’s price, known as the dividend yield.

Benefits of Dividends

Passive Income: Dividends provide investors with a passive stream of income. By investing in dividend-paying stocks or funds, investors can earn regular income without actively trading or relying solely on capital appreciation.

Stability: Dividend-paying stocks are often considered more stable than non-dividend-paying stocks. Companies that consistently pay dividends tend to be well-established and profitable, which can provide a level of stability to investors.

Potential for Growth: Companies that consistently increase their dividend payments over time can provide investors with the potential for income growth. This can be particularly beneficial for long-term investors who reinvest dividends to purchase additional shares.

Diversification: Dividends can offer investors an opportunity for portfolio diversification. By investing in a range of dividend-paying stocks across different sectors, investors can spread their risk and potentially benefit from a mix of stable income and capital appreciation.

Conclusion

Dividends play a crucial role in providing investors with a steady stream of passive income. By understanding how dividends work and the benefits they offer, investors can make informed decisions about incorporating dividend-paying stocks into their investment portfolios. Remember to conduct thorough research and consider factors such as dividend yield, payout ratio, and the company’s financial health when selecting dividend investments.

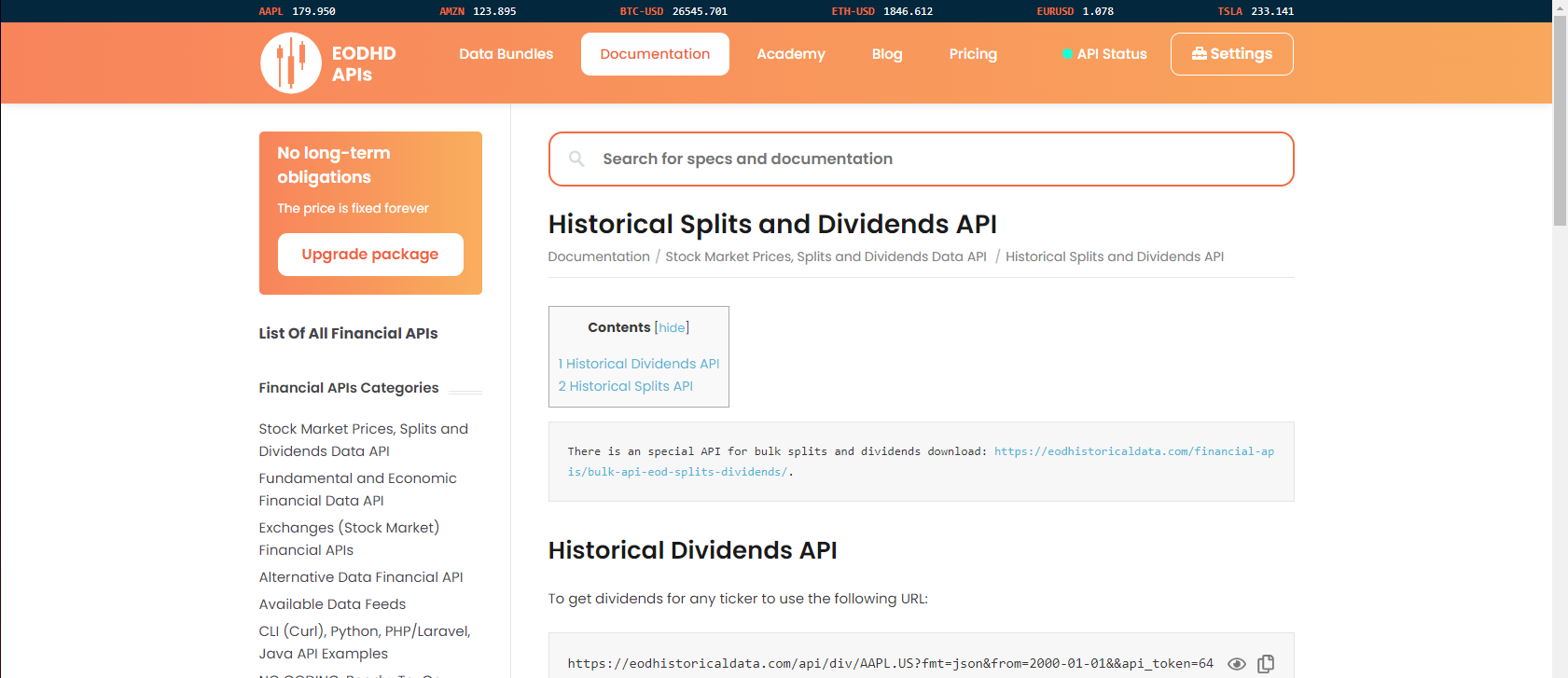

For investors and developers seeking access to dividend data, there is an API available that provides comprehensive and up-to-date information on dividend payments. This API allows users to retrieve dividend data for individual stocks, analyze dividend histories, and incorporate dividend data into their investment strategies and applications. One such example is the dividend data API provided by EODHistoricalData, which offers a reliable and efficient way to access dividend information.

https://eodhistoricaldata.com/financial-apis/api-splits-dividends/