Survivorship bias remains a significant challenge in financial analysis, distorting perceptions and influencing decision-making processes. The focus on data from listed companies often overlooks delisted entities, leading to skewed perceptions of market trends and performance. For example, if data from only successful, listed companies is analyzed, the challenges and failures faced by non-listed entities are overlooked. IT paints an incomplete picture of industry dynamics. That’s why it is crucial to have access to historical data for delisted companies and incorporate them into an analysis.

For instance, during the dot-com bubble, many internet startups were highly valued. However, after the bubble burst, numerous companies ceased operations and were delisted, resulting in a significant distortion of historical data.

Quick jump:

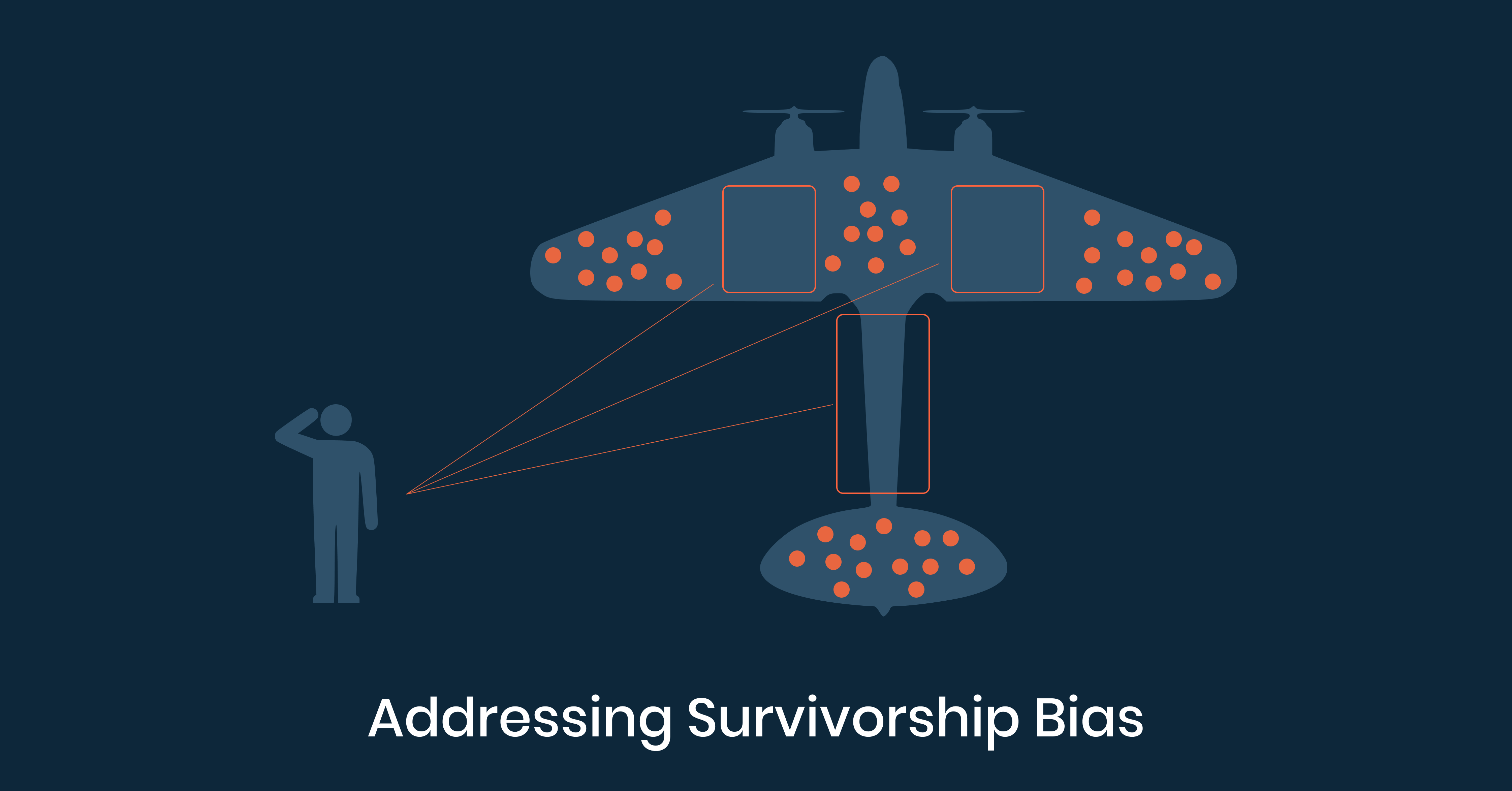

Survivorship Bias

Survivorship bias arises when analyses exclusively use data for currently active companies, neglecting those that have been delisted. This bias can lead to distorted historical data, as failed businesses and delisted companies are excluded from the analysis.

Delisted companies often exit the market due to financial distress, bankruptcy, or other adverse circumstances. Ignoring these companies in historical analysis can result in an incomplete perspective, masking the prevalence and impact of market downturns, industry disruptions, and economic recessions.

Risks of Using Biased Data

The risks of not including delisted companies in financial analysis are significant and can lead to flawed decision-making.

Excluding delisted companies from analysis results in an incomplete historical record. Failed businesses and delisted companies provide valuable insights into market volatility, industry trends, and economic cycles. Ignoring this data hampers the ability to accurately assess long-term performance and make informed predictions.

Excluding delisted companies also limits the opportunity for portfolio diversification, as investors may overlook sectors or industries that have experienced significant turbulence or disruption. This lack of diversification can increase portfolio volatility and exposure to specific market risks.

Getting the Right Data

While recognizing the importance of non-listed company data is paramount, accessing such information poses certain challenges. Unlike their listed counterparts, non-listed companies may not disclose financial data publicly, making it harder to gather comprehensive information. However, advancements in technology, such as EODHD’s APIs, provide solutions to bridge this gap by offering access to extensive datasets encompassing both listed and delisted entities, providing historical data for both.

EODHD has Fundamental, End-of-Day, News, and Intraday data for delisted companies. This data could be included the data directly in your application, spreadsheet, or data visualization tool.

If you are visiting the platform for the first time please check our brief guide. To access the data it’s important to get the list of delisted tickers, EODHD provides an Exchange API point dedicated to this. An example of the API request is the following:

https://eodhd.com/api/exchange-symbol-list/US?api_token=YOUR_API_TOKEN&fmt=json&delisted=1

The API URL differs from the list of listed companies only by the parameter “&delisted=1”. Without this parameter you’ll get the list of currently traded companies.

After delisting companies lose their ticker codes, newly traded companies are free to reuse them. EODHD system marks tickers with the index ‘old’. For example, ACR_old.US was traded as ACR before delisting and now another company trades under ACR.US.

After getting the list of tickers it’s easy to access the data for them. Fundamental, End-of-Day, News, and Intraday data API endpoints are available for delisted companies and called in the same way as listed companies.

For example, an Intraday data you could use the following URL API:

https://eodhd.com/api/intraday/TWTR.US?interval=5m&api_token=YOUR_API_TOKEN&fmt=csv&from=1627896900&to=1630575300

Note that without the ‘&from=’ and ‘&to=’ parameters specified, the length of the data obtained includes the previous 120 days, API requests for tickers that were delisted earlier won’t return the data for the period when they were not traded.

Use case: Survivorship Free Historical Analysis of S&P500

EODHD Fundamentals API provides the data for Indeces’ historical constituents which could be used to analyze the market at a certain time period. However, some companies from the chosen period could be delisted and if not included could severely impact the analysis. One such company is Twitter which was delisted at 44b market cap in 2022. From 2020 to 2021 it rose 3 fold and can’t be ignored.

To get historical index constituents for S&P 500 you can use the following URL API request:

https://eodhd.com/api/fundamentals/GSPC.INDX?api_token=YOUR_API_KEY&fmt=json&&filter=HistoricalTickerComponents

Parameter “&filter=HistoricalTickerComponents” limits the output of the API to only the Historical Components section of the index fundamental API.

After getting a list of tickers and timeframes of them being included in S&P500 you could call EOD Historical API for each of them for a given period with the following URL API request:

https://eodhd.com/api/eod/TWTR.US?from=2020-01-05&to=2020-02-10&period=d&api_token=YOUR_API_KEY&fmt=json

Conclusion

Incorporating non-listed company data into financial analysis is essential for overcoming survivorship bias and making well-informed decisions. By acknowledging the contributions of both listed and non-listed entities, analysts can gain deeper insights into market dynamics, identify emerging trends and opportunities, and effectively manage risks. In today’s rapidly evolving financial landscape, embracing a comprehensive approach that includes data from all companies, regardless of their listing status, is crucial for achieving sustainable growth and success. Mitigating the impact of survivorship bias and making more informed investment decisions will lead to exceptional financial analysis.

Feel free to contact support to ask for the current discounts, we would be more than happy to assist and guide you through the process.